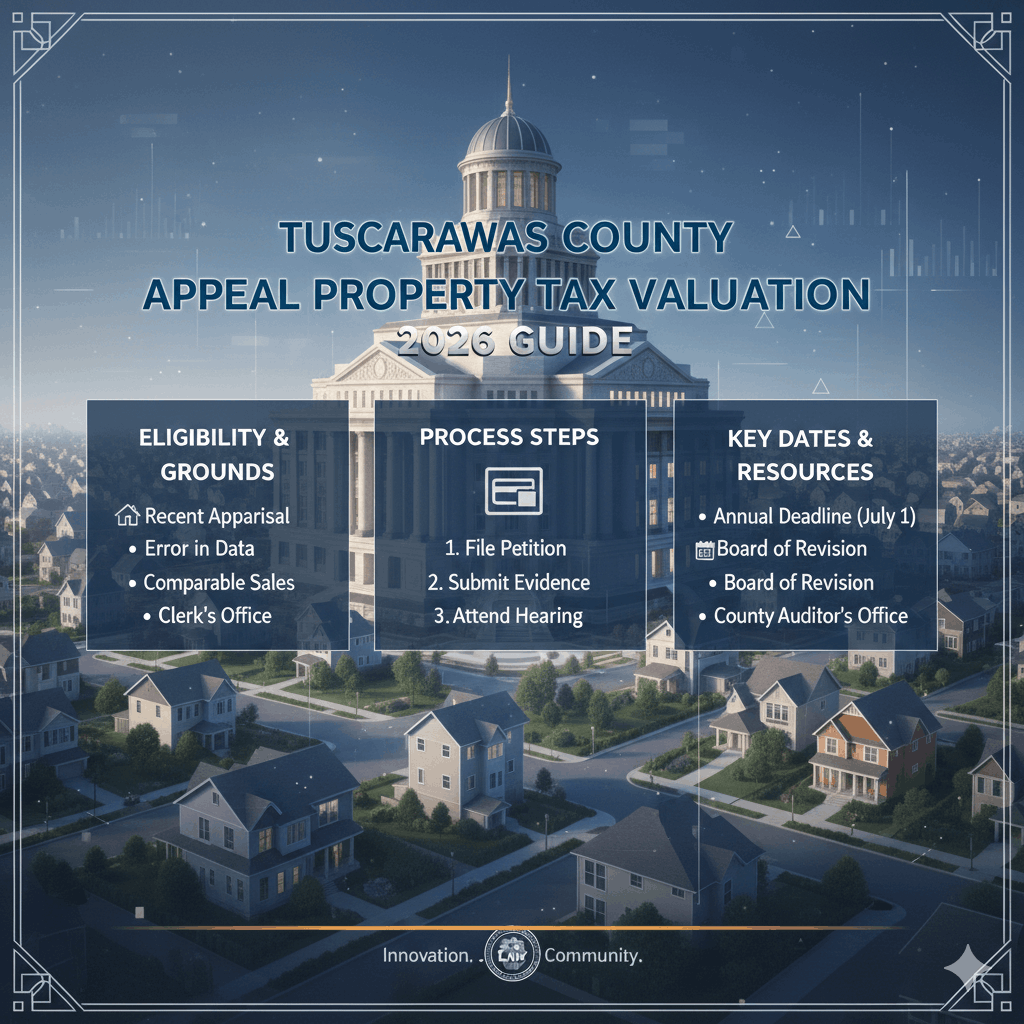

Appeal Property Tax Valuation in Tuscarawas County Ohio 2026

Property taxes are a significant expense for homeowners, and in Tuscarawas County2026 Ohio, it’s not uncommon to feel that your property has been overvalued. Overpaying property taxes can strain your budget, but the good news is that you have the right to appeal your property tax valuation. Understanding the process can save you money and ensure that your property taxes are fair and accurate.

Understanding Property Tax Valuation

Before you appeal, it’s important to understand how your property is valued. In Tuscarawas County, the County Auditor is responsible for determining the assessed value of properties. The valuation is based on factors such as:

- Market Value – the estimated price your property would sell for on the open market.

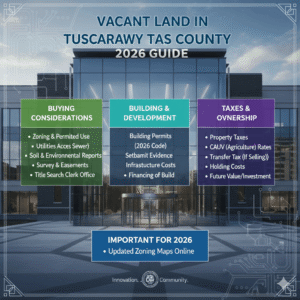

- Property Type – residential, commercial, agricultural, or vacant land.

- Location – neighborhood trends, proximity to amenities, and local development.

- Improvements – additions or renovations that can affect your property’s value.

The Auditor updates valuations periodically to reflect changes in the real estate market. If you believe your property’s assessed value is higher than its true market value, an appeal may be necessary.

Steps to Appeal Your Property Tax Valuation

Appealing your property tax valuation in Tuscarawas County involves several steps. Here’s a clear, step-by-step guide:

1. Review Your Property Record

Start by obtaining your property record card from the Tuscarawas County Auditor’s website. This record provides information about your property’s assessed value, tax history, and any improvements noted by the auditor. Verify that all the details are correct. Errors in square footage, number of rooms, or property type can affect your valuation and strengthen your appeal.

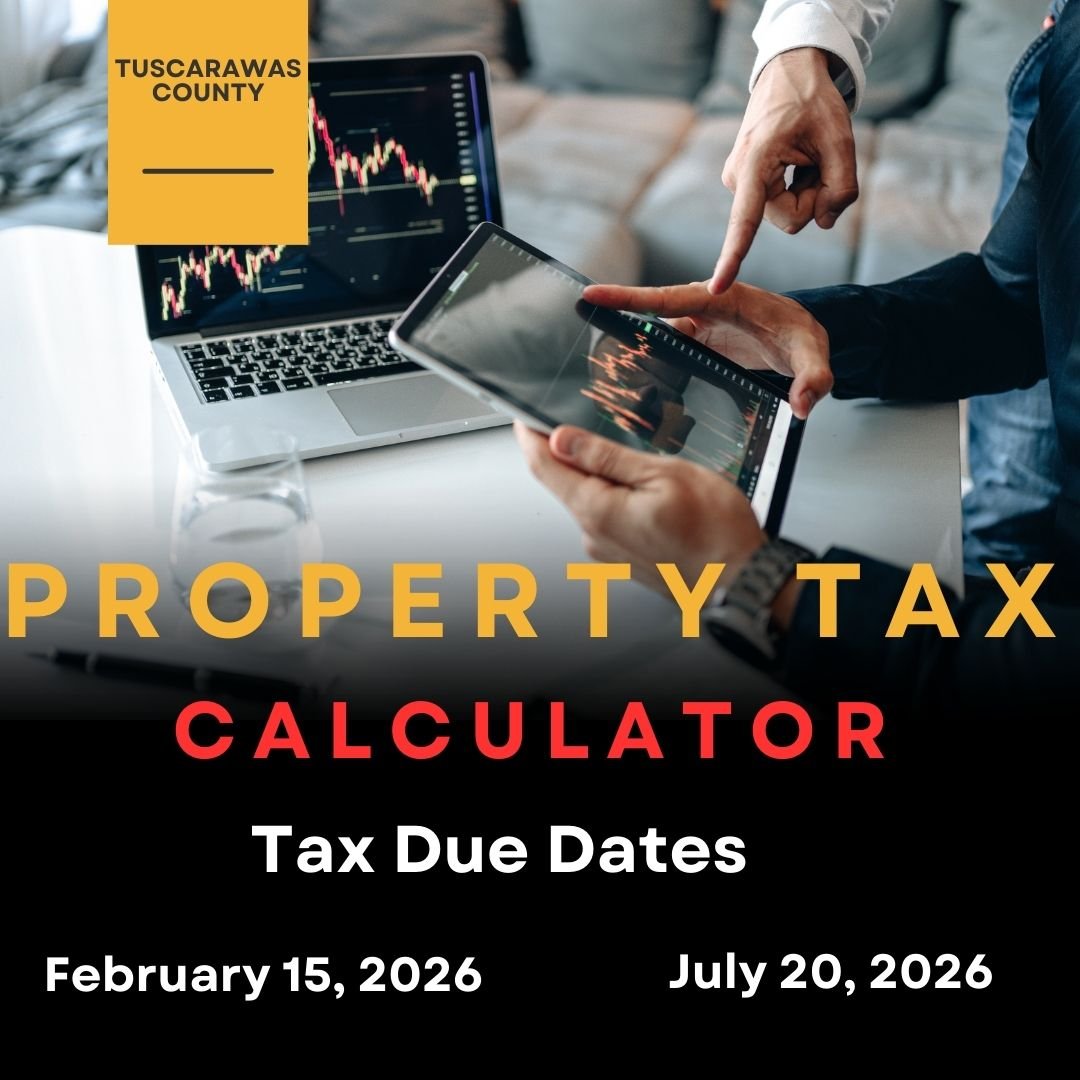

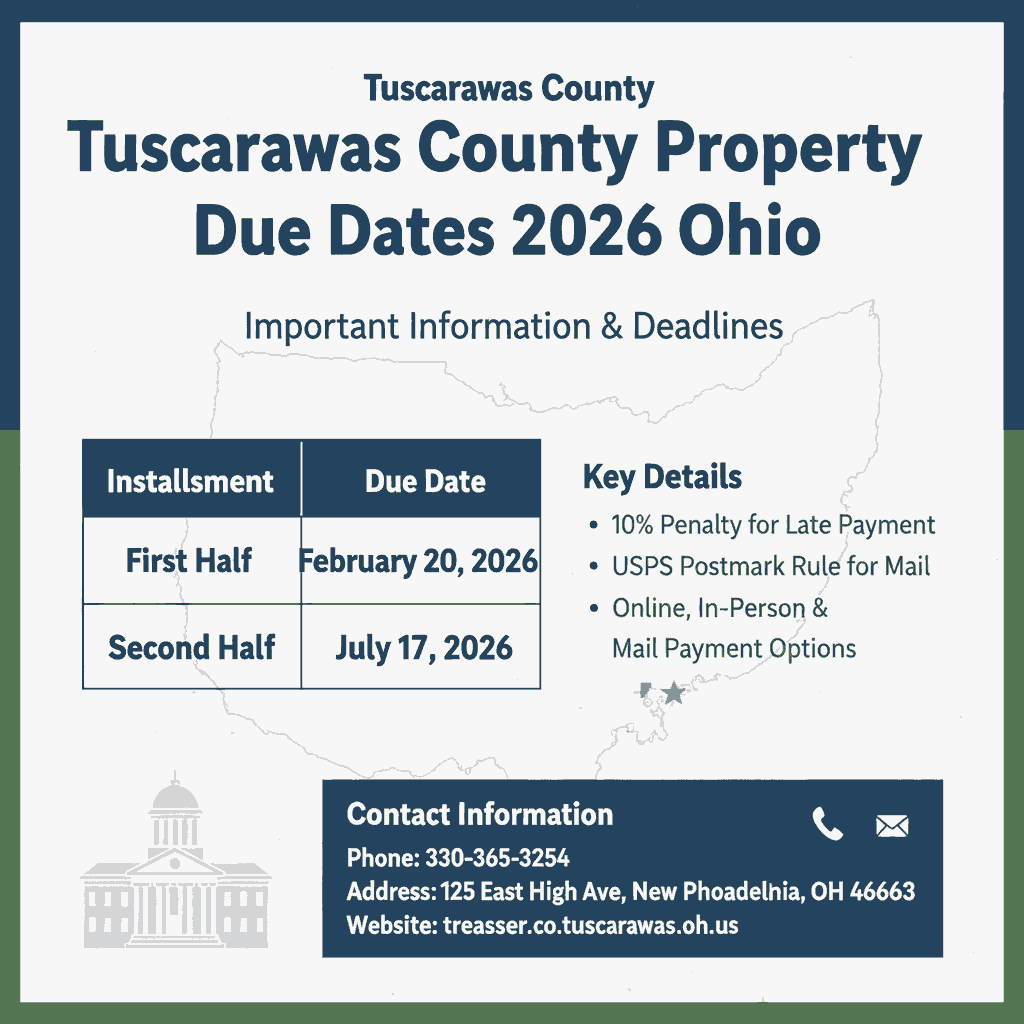

2. Understand the Appeal Deadline

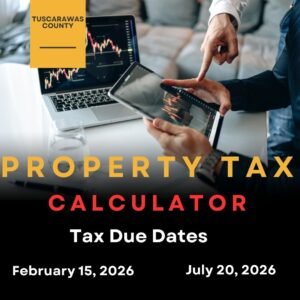

Property owners in Tuscarawas County must submit appeals by a certain deadline. For real property, the deadline is generally March 31st of the tax year in question. Filing late may result in your appeal being denied, so mark your calendar and prepare in advance.

3. Gather Evidence

Your appeal is stronger when supported by solid evidence. Consider collecting the following:

- Recent Appraisals: a professional appraisal can provide an independent assessment of your property’s market value.

- Comparable Sales: look for similar properties in your area that sold for less than your assessed value.

- Photographs: document any issues or damages that may lower your property’s value.

- Tax Records: previous years’ valuations and tax bills can help demonstrate inconsistencies.

4. File Your Appeal

In Tuscarawas County, appeals are filed with the Board of Revision (BOR). You can submit your appeal online, by mail, or in person. Make sure to include:

- A completed Board of Revision appeal form.

- Copies of all supporting evidence.

- Contact information and property details.

5. Attend the Hearing

After filing, you’ll receive a notice of your hearing date. During the hearing, you or your representative can present your evidence. The BOR will review your case and may ask questions. Being organized and professional during the hearing improves your chances of success.

6. Receive the Decision

The Board of Revision will send a written decision. If your appeal is successful, your property’s assessed value and your taxes will be adjusted accordingly. If the appeal is denied, you may have the option to appeal further to the Ohio Board of Tax Appeals.

Tips for a Successful Property Tax Appeal

- Start Early: The process takes time, and gathering evidence can be lengthy.

- Be Accurate: Double-check all documents and ensure your property details are correct.

- Know the Market: Familiarize yourself with recent local sales and property trends.

- Stay Professional: Communicate respectfully with county officials and present clear evidence.

Common Mistakes to Avoid

- Missing Deadlines: Late appeals are rarely accepted.

- Weak Evidence: Claims without proof are unlikely to succeed.

- Ignoring Errors: Small mistakes in property records can be grounds for appeal, so don’t overlook them.

- Not Understanding the Process: Read the guidelines from the Tuscarawas County Auditor to avoid procedural errors.

Conclusion

Appealing your property tax valuation in Tuscarawas County is a practical way to ensure your taxes are fair. By understanding your property’s assessed value, gathering strong evidence, and following the official process, you can potentially lower your tax burden. Remember, preparation, accuracy, and professionalism are key to a successful appeal.

Taking the time to review your property’s valuation and filing a well-supported appeal can make a meaningful difference in your finances. Even a small reduction in assessed value can save hundreds—or even thousands—of dollars over time.

Frequently Asked Questions (FAQs)

1. Who can file a property tax appeal in Tuscarawas County

Any property owner or authorized representative can file an appeal if they believe their property is overvalued.

2. How much does it cost to appeal a property tax valuation

Filing an appeal with the Board of Revision is generally free. However, professional appraisals or legal representation may incur costs.

3. How long does the appeal process take

The process can take several weeks to a few months, depending on the complexity of your case and the BOR’s schedule.

4. Can I appeal if my property value was reduced last year

Yes. Each tax year is separate, and you can appeal if you believe the current valuation is inaccurate.

5. What evidence is most effective for an appeal

Comparable property sales, professional appraisals, property records, and photographs of any issues are considered strong evidence.

6. What happens if my appeal is denied

If denied, you may appeal further to the Ohio Board of Tax Appeals for a higher review.

Post Comment