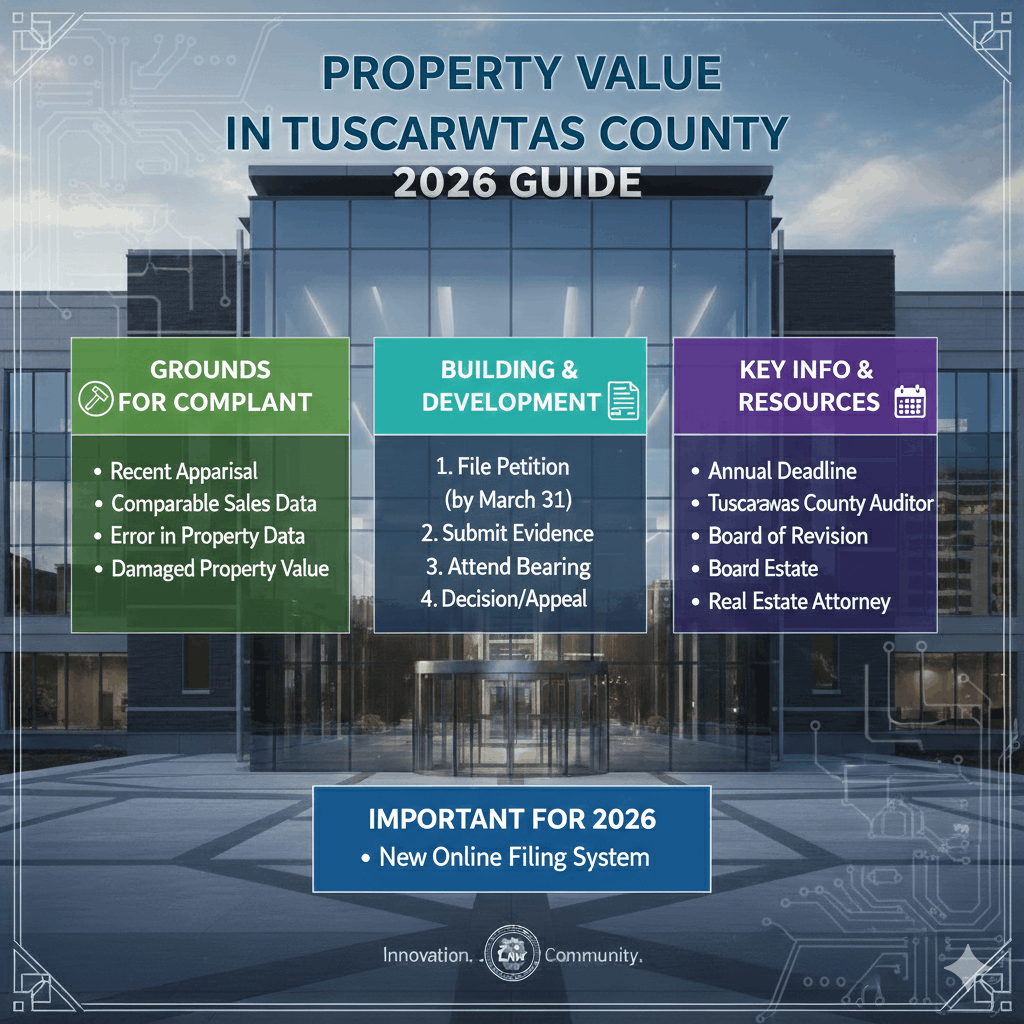

Property Value Complaint in Tuscarawas County 2026

Property owners in Tuscarawas County, Ohio, can challenge their property’s assessed value if it does not reflect fair market value by filing a complaint with the Board of Revision. This process uses Form DTE 1 and is submitted to the County Auditor’s Office, usually between January 1 and March 31. Owners must explain the requested change and provide supporting evidence such as recent sales, appraisals, or proof of damage to justify a corrected valuation.

Understanding Property Valuation in Tuscarawas County

Property in Tuscarawas County is assessed by the County Auditor’s Office. The auditor determinesthe value of real estate based on factors like:

- Property type: Residential, commercial, or agricultural

- Size and location: Lot size, neighborhood trends, and nearby developments

- Condition of the property: Age, renovations, and general upkeep

- Comparable sales: Recent sales of similar properties in the area

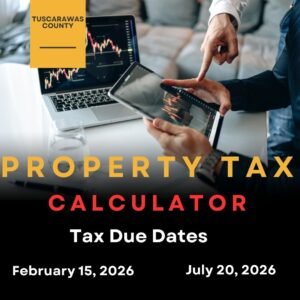

Once your property is assessed, you receive a Notice of Valuation. This notice indicates the market value of your property and helps calculate yourproperty taxes.

When to File a Property Value Complaint

You may consider filing a complaint if:

- Your property’s assessed value is higher than similar properties in your neighborhood

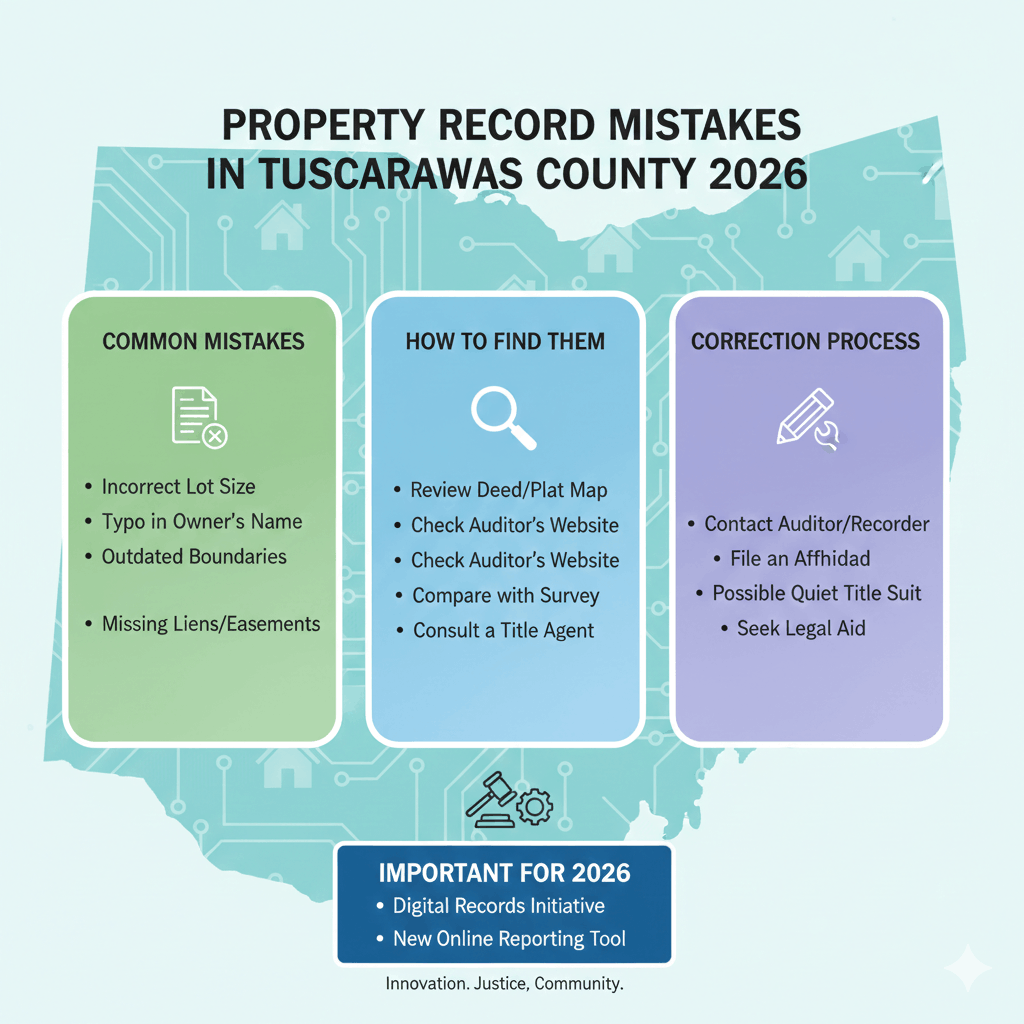

- There are errors in property details, such as square footage or lot size

- The condition of your property has changed and is not reflected in the current assessment

- Comparable properties have sold for less than your assessed value

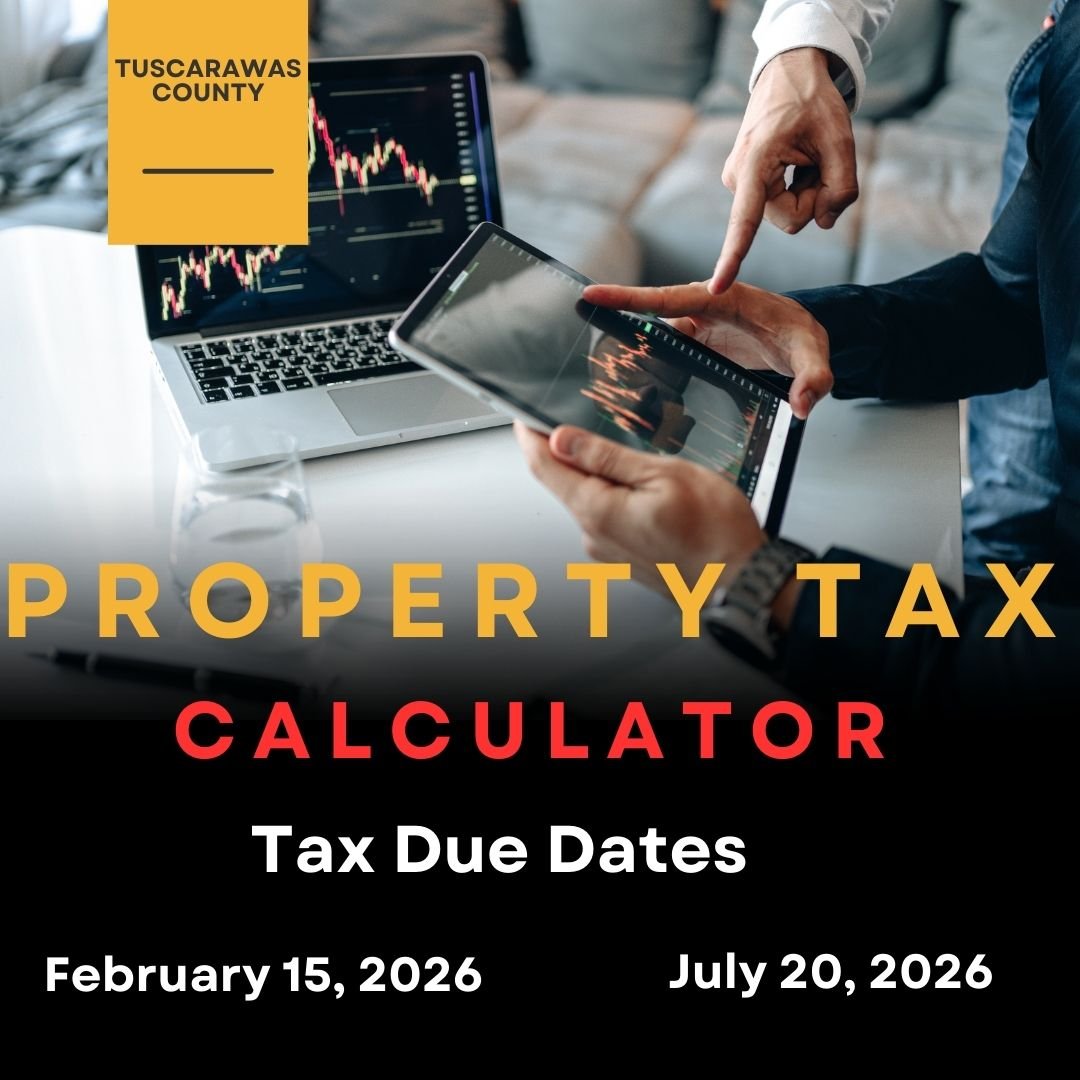

It’s important to act promptly, as property value complaints are typically time-sensitive. The Ohio Revised Code sets deadlines for filing complaints each year.

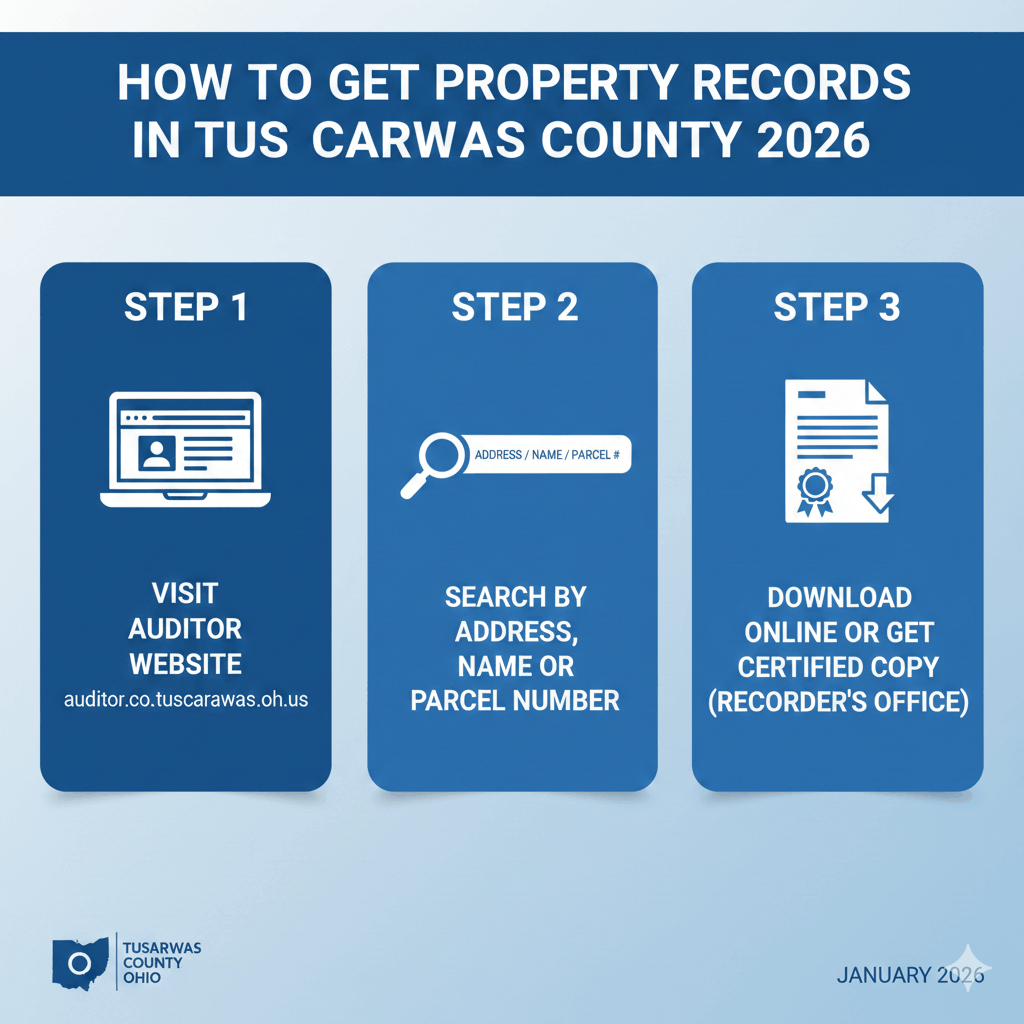

Steps to File a Property Value Complaint in Tuscarawas County

Filing a complaint can seem complicated, but following these steps ensures a smoother process:

1. Review Your Property Valuation Notice

Check the details carefully. Look for:

- Assessed market value

- Property description (square footage, lot size, improvements)

- Classification of property (residential, commercial, etc.)

Make sure all information is accurate. Errors can be grounds for a complaint.

2. Gather Evidence

The more evidence you provide, the stronger your case. Useful documents include:

- Recent appraisal reports

- Comparable property sales

- Photographs showing property condition

- Receipts or records of home improvements or repairs

3. Complete the Complaint Form

Tuscarawas County provides a Property Value Complaint Form, which you can obtain from the County Auditor’s Office or their website. Fill in details such as:

4. Submit the Complaint

You can submit your complaint in person, by mail, or online, depending on the county’s current procedures. Make sure you retain a copy for your records.

5. Attend the Hearing

After submission, you may receive a notice for a formal hearing. At the hearing:

- Present your evidence clearly and professionally

- Explain why you believe the property value is incorrect

- Respond to any questions from the Board of Revision or county officials

6. Await Decision

After the hearing, the Board of Revision will decide whether to adjust your property value. You will receive a written notice of their decision. If you disagree, you may appeal further under Ohio law.

Tips for a Successful Property Value Complaint

- Act Early: Filing before the deadline is critical. Missing the deadline usually results in denial.

- Be Detailed: Provide as much evidence as possible to support your claim.

- Stay Professional: Keep communication polite and factual.

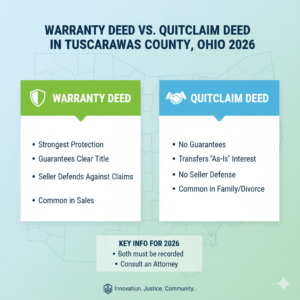

- Consult Professionals: A local real estate appraiser or attorney can provide guidance.

- Know Your Rights: Familiarize yourself with Ohio Revised Code Sections 5715 and 5717, which govern property valuation complaints.

Common Mistakes to Avoid

- Failing to verify the property details on your notice

- Missing the filing deadline

- Providing insufficient evidence

- Making the complaint personal instead of factual

- Ignoring instructions from the County Auditor’s Office

Conclusion

Filing a property value complaint in Tuscarawas County can help ensure your property is assessed fairly, potentially reducing your property taxes. The key is to act promptly, gather strong evidence, and follow the process carefully. By understanding the steps and preparing thoroughly, property owners can confidently challenge inaccurate valuations and protect their financial interests.

Frequently Asked Questions (FAQs)

1. Who can file a property value complaint

Any property owner in Tuscarawas County who believes their property is overvalued can file a complaint.

2. What is the deadline for filing a complaint

Deadlines vary each year. Check the Tuscarawas County Auditor’s Office website for the exact filing window.

3. Is there a fee to file a complaint

No, filing a property value complaint is typically free of charge.

4. Can I appeal the decision if my complaint is denied

Yes, you may appeal through the Ohio Board of Tax Appeals or other legal channels.

5. What evidence is most effective for a complaint

Appraisal reports, comparable property sales, photos of your property, and records of repairs or renovations are highly effective.

6. How long does the complaint process take

The timeline varies, but most decisions are issued within a few months after the hearing.

Post Comment