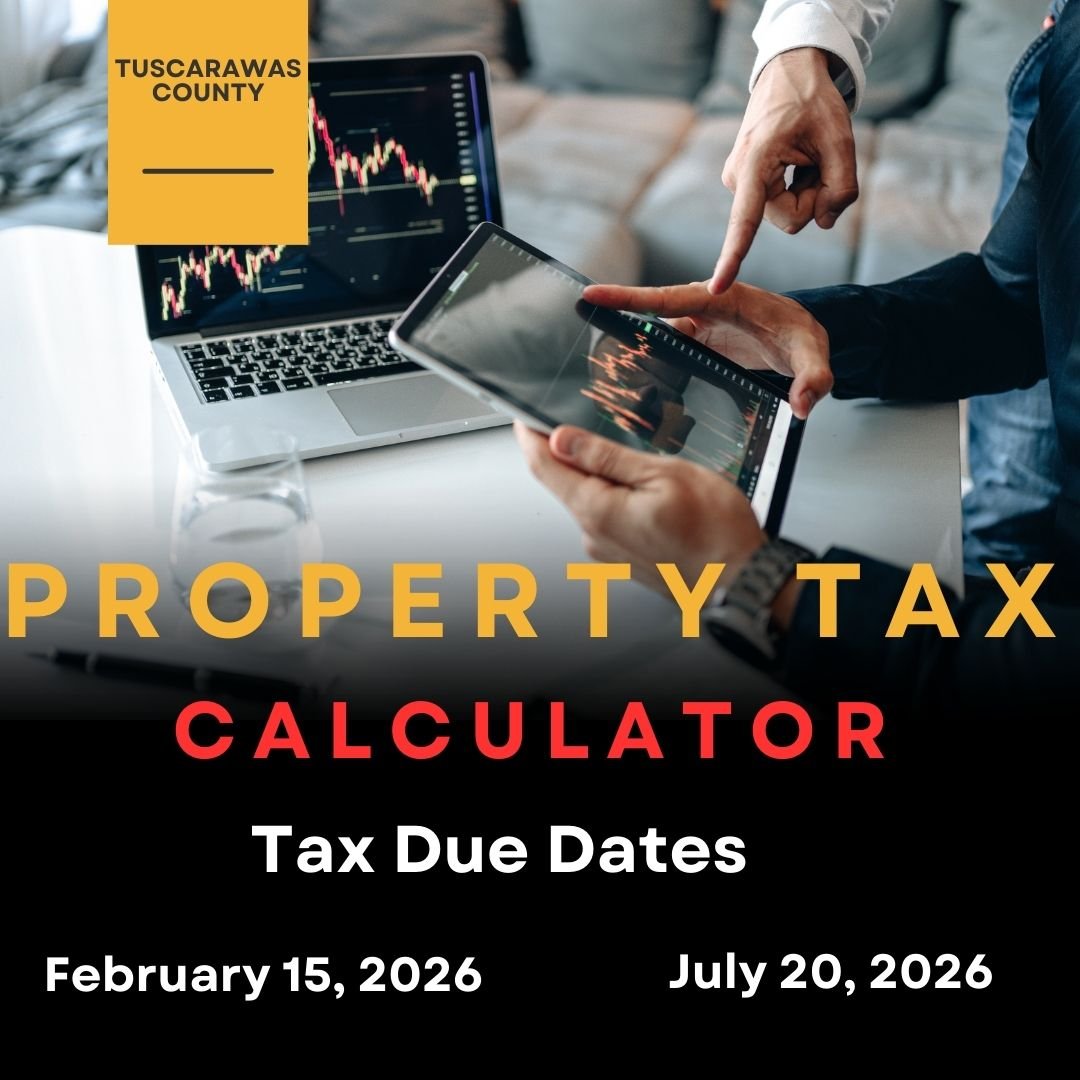

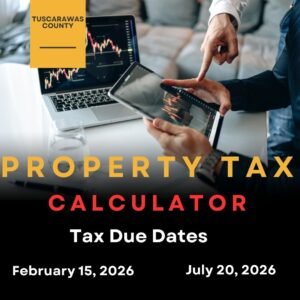

How to Pay Property Taxes in Tuscarawas County Ohio 2026

Paying property taxes in Tuscarawas County 2026 Ohio, is an essential responsibility for homeowners, but the process doesn’t have to be confusing. Whether you’re a first-time property owner or simply need a refresher, this guide will walk you through everything you need to know about paying your property taxes on time, the available payment options, and helpful tips to stay organized.

Understanding Property Taxes in Tuscarawas County

Property taxes are collected by the Tuscarawas County Auditor and Treasurer’s Office. These taxes help fund local services such as public schools, roads, emergency services, and other community programs. The tax amount is based on the assessed value of your property, which is determined by the county auditor, and the local tax rate.

It’s important to note that property taxes in Ohio are typically divided into two installments: the first half is due around January 20th, and the second half is due by July 20th. Paying on time is crucial, as late payments can incur penalties and interest.

How Property Taxes Are Calculated

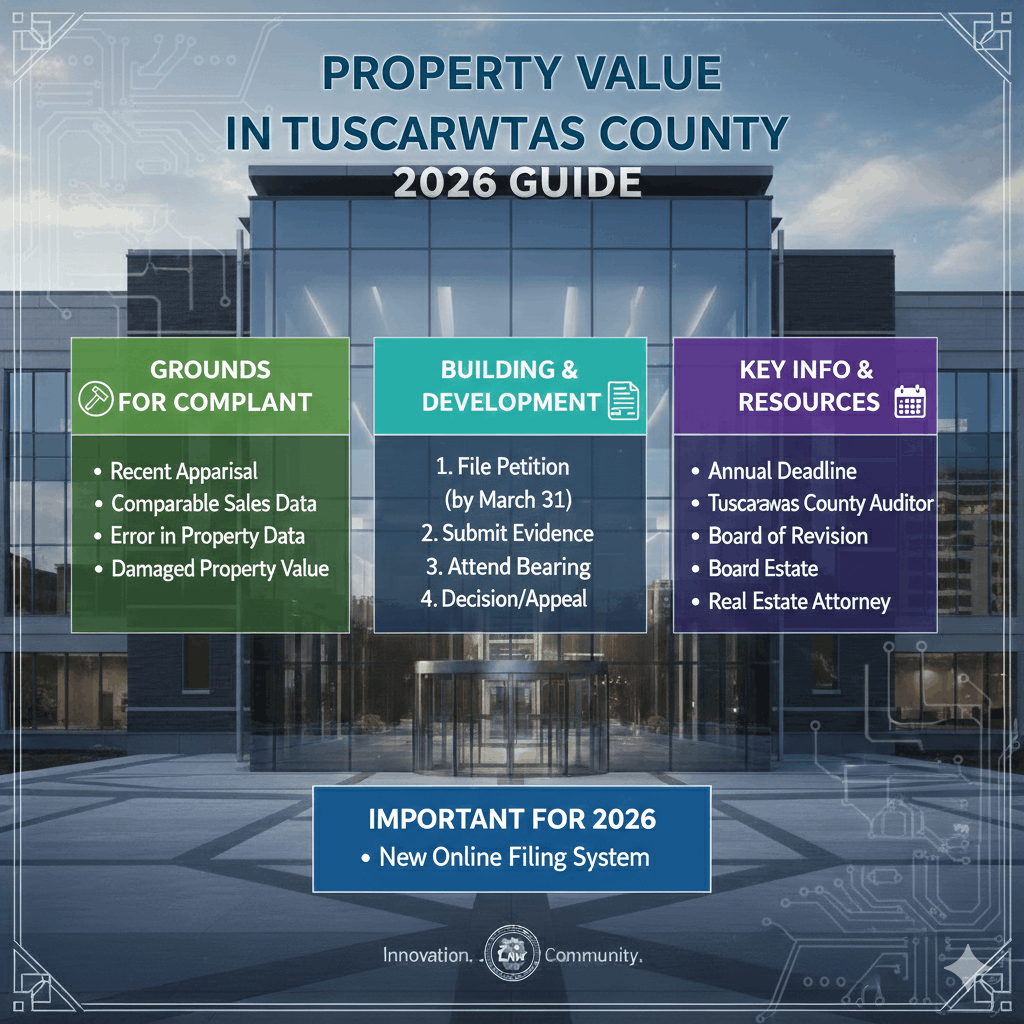

The Tuscarawas County Auditor calculates property taxes based on the assessed value of your property. This value is determined through regular property assessments, which consider factors such as location, size, and improvements made to the property.

Once your property’s assessed value is determined, it is multiplied by the local tax rate to calculate the total amount owed. The local tax rate varies depending on the school district, township, or municipality in which your property is located.

Payment Methods for Tuscarawas County Property Taxes

Tuscarawas County offers multiple convenient ways for homeowners to pay property taxes:

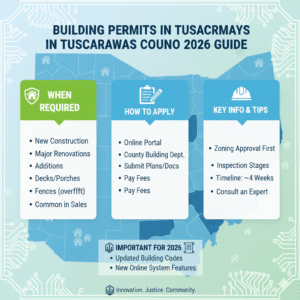

1. Online Payments

The county provides a secure online portal through the Tuscarawas County Treasurer’s website. You can pay using a debit or credit card, or through an electronic check. Online payments are fast, safe, and provide immediate confirmation for your records.

Steps to pay online:

- Visit the Tuscarawas County Treasurer’s website.

- Click on “Pay Property Taxes Online.”

- Enter your property parcel number or address.

- Review your tax bill and select your payment method.

- Submit your payment and save the confirmation receipt.

2. By Mail

You can also pay your property taxes by mailing a check or money order. Be sure to include your tax statement or parcel number on the payment. Send it to the address listed on your property tax bill.

Tips:

- Mail your payment at least a week before the due date to avoid late fees.

- Always keep a copy of your payment for your records.

3. In Person

Payments can be made directly at the Tuscarawas County Treasurer’s Office. This method is ideal if you prefer speaking to a staff member, need assistance, or want to pay in cash.

Office Address:

Tuscarawas County Treasurer’s Office

125 East High Avenue

New Philadelphia, OH 44663

4. Payment Plans

If paying your full property tax amount at once is difficult, you can inquire about installment or payment plan options. These plans may allow you to spread your payments over multiple months. Contact the Treasurer’s Office for eligibility and application details.

Tips for Paying Property Taxes on Time

- Keep Track of Deadlines: Mark January 20th and July 20th on your calendar to avoid penalties.

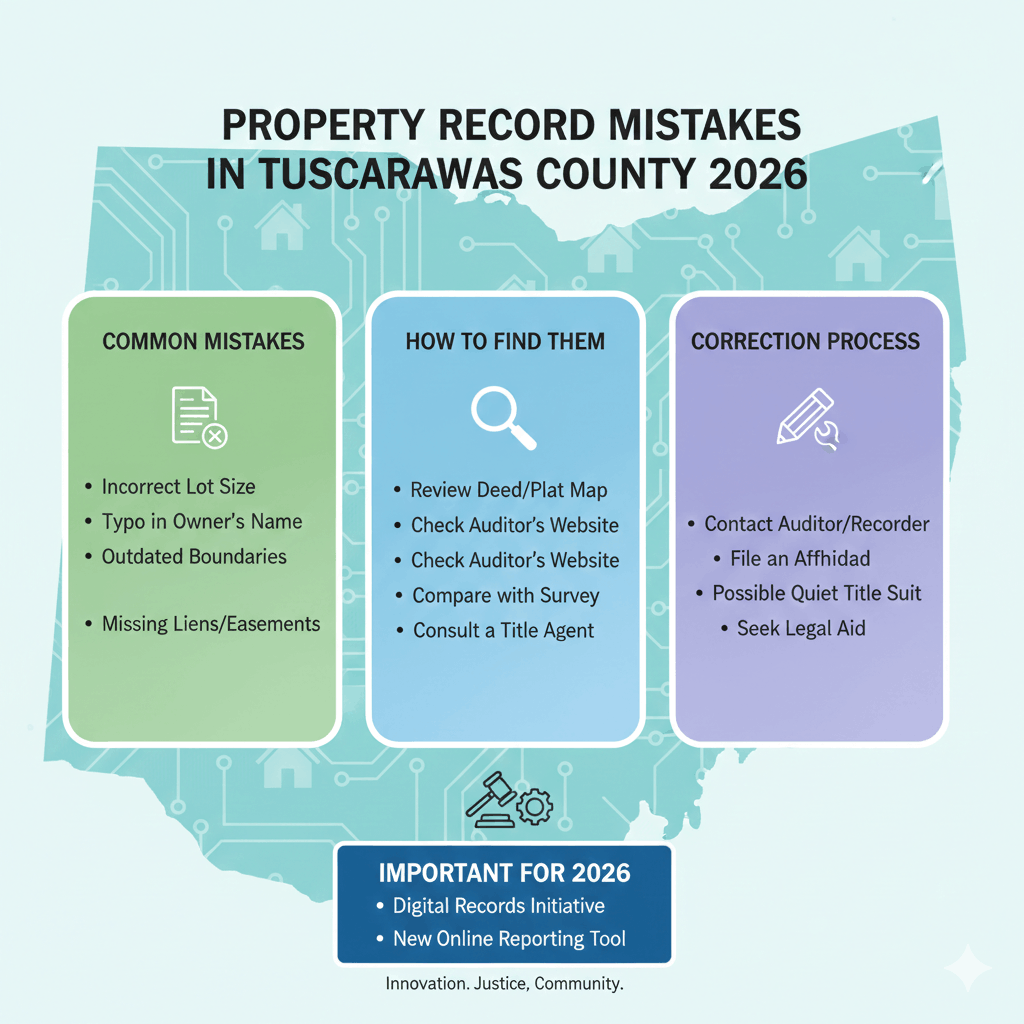

- Check Your Tax Bill: Verify the assessed value and ensure there are no errors.

- Set Up Reminders: Use your phone or email to set payment reminders.

- Use Secure Payment Methods: Always pay through official county channels to prevent fraud.

Conclusion

Paying property taxes in Tuscarawas County doesn’t have to be complicated. By understanding how taxes are calculated, staying aware of deadlines, and using the convenient payment options available, homeowners can manage their property tax obligations efficiently. Always review your tax bill for accuracy, explore exemptions if eligible, and keep records of all payments. Staying proactive ensures you avoid penalties and contribute to maintaining vital services in your community.

Common Property Tax Questions in Tuscarawas County

Q1: How can I find my property tax bill?

You can view and print your property tax bill through the Tuscarawas County Treasurer’s online portal using your parcel number or property address.

Q2: What if I cannot pay my property taxes on time?

Late payments may result in interest and penalties. Contact the Treasurer’s Office to discuss potential payment plans or extensions.

Q3: Are there exemptions available?

Certain exemptions may apply, such as homestead exemptions for seniors, disabled veterans, or low-income homeowners. Check with the Auditor’s Office for eligibility requirements.

Q4: Can I pay my taxes with a credit card?

Yes, Tuscarawas County accepts credit card payments online. Be aware that service fees may apply.

Q5: How do I know my property’s assessed value?

The Tuscarawas County Auditor determines the assessed value through regular property assessments. You can check your property value on the Auditor’s website.

Q6: Who should I contact for questions about property taxes?

For payment questions, contact the Treasurer’s Office. For assessment or valuation questions, contact the Auditor’s Office.

Post Comment