Property Record Mistakes in Tuscarawas County Ohio2026

Accurate property records are essential for homeowners, buyers, and real estate professionals in Tuscarawas County. These records are used for property taxes, buying and selling homes, legal matters, and more. However, errors in property records are more common than many people realize. Understanding these mistakes, their consequences, and how to correct them can save you time, money, and potential legal headaches.

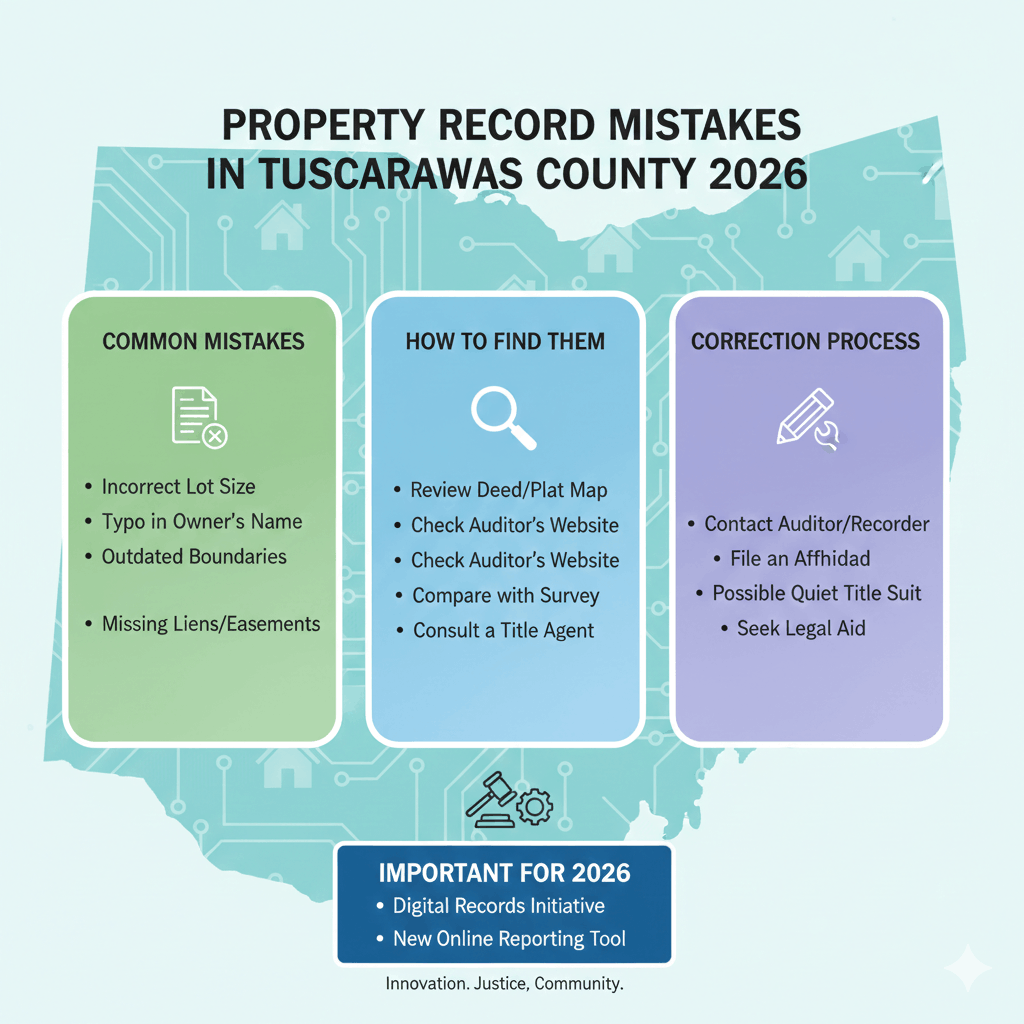

Common Types of Property Record Mistakes

- Incorrect Owner Information

One of the most common errors in Tuscarawas County property records is incorrect owner information. This may include misspelled names, outdated ownership after a sale, or failing to reflect a property transfer. Errors like these can cause confusion when selling a home or applying for permits. - Wrong Property Address

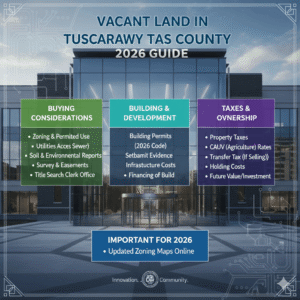

Sometimes, property’s address in the county records may not match the actual physical location. This is especially common in rural areas or subdivisions with new developments. A wrong address can affect mail delivery, emergency services, and tax notices. - Parcel or Lot Number Mistakes

Each property in Tuscarawas County has a unique parcel number. If the parcel number is entered incorrectly in official records, it can create serious issues in property transactions, tax assessments, and public records searches.

Incorrect Property Descriptions

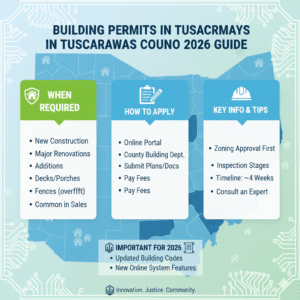

Property descriptions include details like lot building permits, or inaccurate tax assessments.

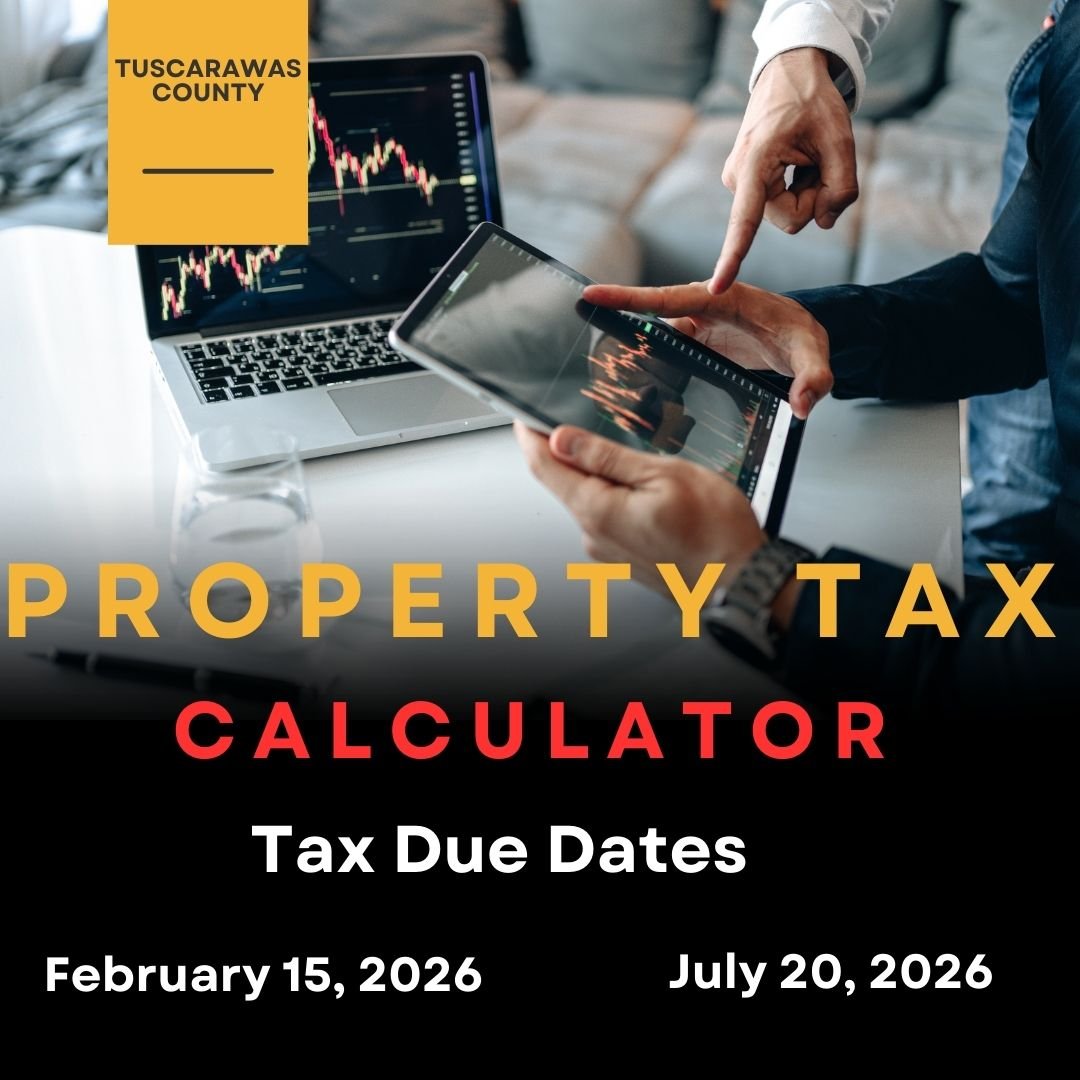

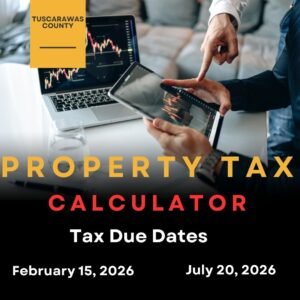

- Outdated Tax Information

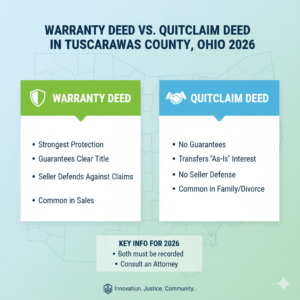

Property taxes are based on the records maintained by the county auditor. If tax information is not updated to reflect improvements, demolitions, or zoning changes, property owners may end up paying too much or too little in taxes. - Recording Mistakes for Legal Documents

Errors can occur during the recording of deeds, mortgages, or easements. These mistakes can cause ownership disputes, title problems, and delays in property transfers.

Causes of Property Record Mistakes

Property record mistakes often happen due to a combination of human error and system issues:

- Data Entry Errors: Typing mistakes or misreading documents can cause wrong names, numbers, or property details to be entered.

- Delayed Updates: Property transactions, improvements, or changes in ownership may not be promptly updated in county records.

- Surveying Errors: Incorrect property boundaries or lot measurements can be recorded if the initial survey was inaccurate.

- Clerical Oversights: Small oversights during the processing of legal documents can result in long-term record issues.

How Property Record Mistakes Affect You

Property record errors may seem minor, but they can have serious consequences:

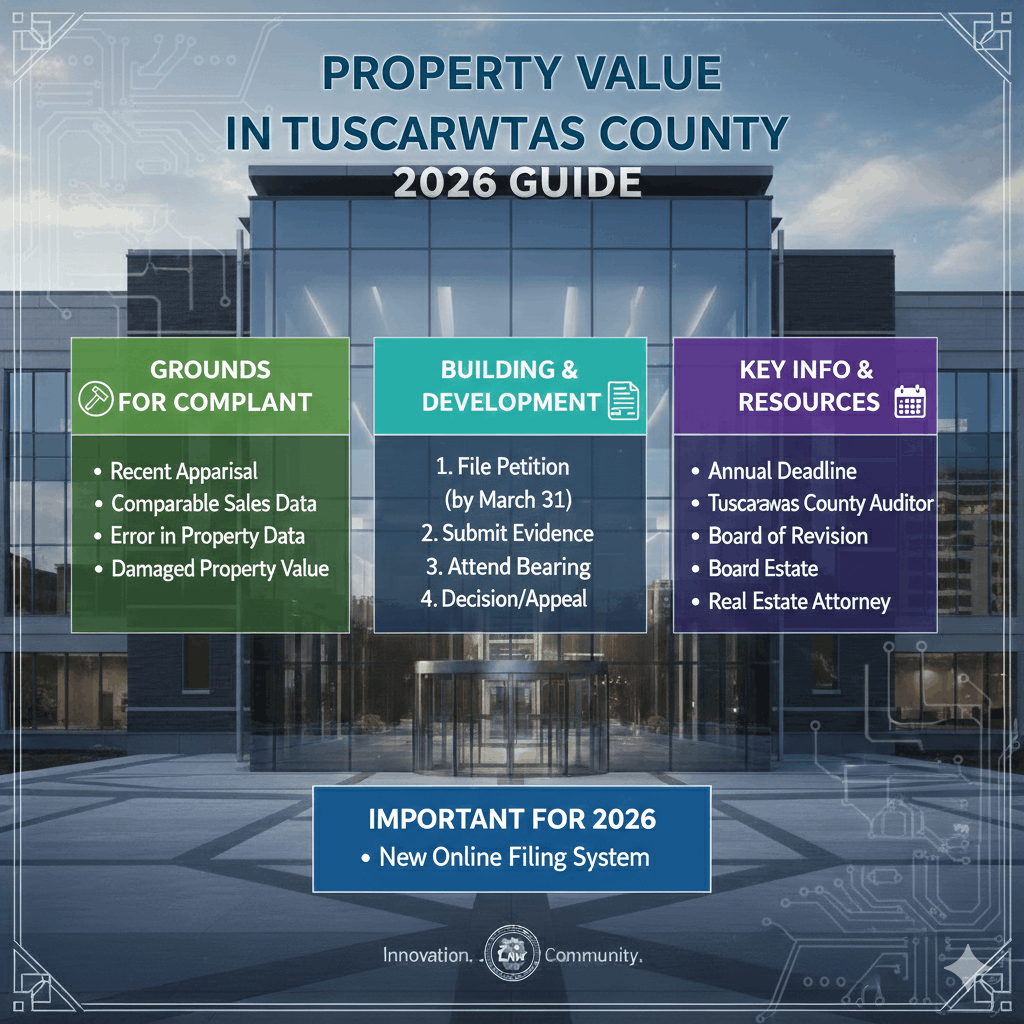

- Legal Issues: Incorrect ownership or boundaries can lead to disputes with neighbors or legal claims.

- Financial Problems: Errors in tax assessments or property valuations may result in overpayment or underpayment of property taxes.

- Difficult Transactions: Selling or refinancing a home can be delayed if county records are inaccurate.

- Impact on Property Value: Inaccurate records may affect appraisals and reduce the perceived value of your property.

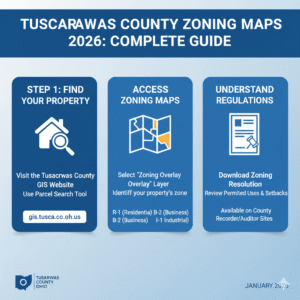

How to Identify Errors in Tuscarawas County Property Records

Regularly reviewing your property records can help identify mistakes before they cause major problems. Here are some steps you can take:

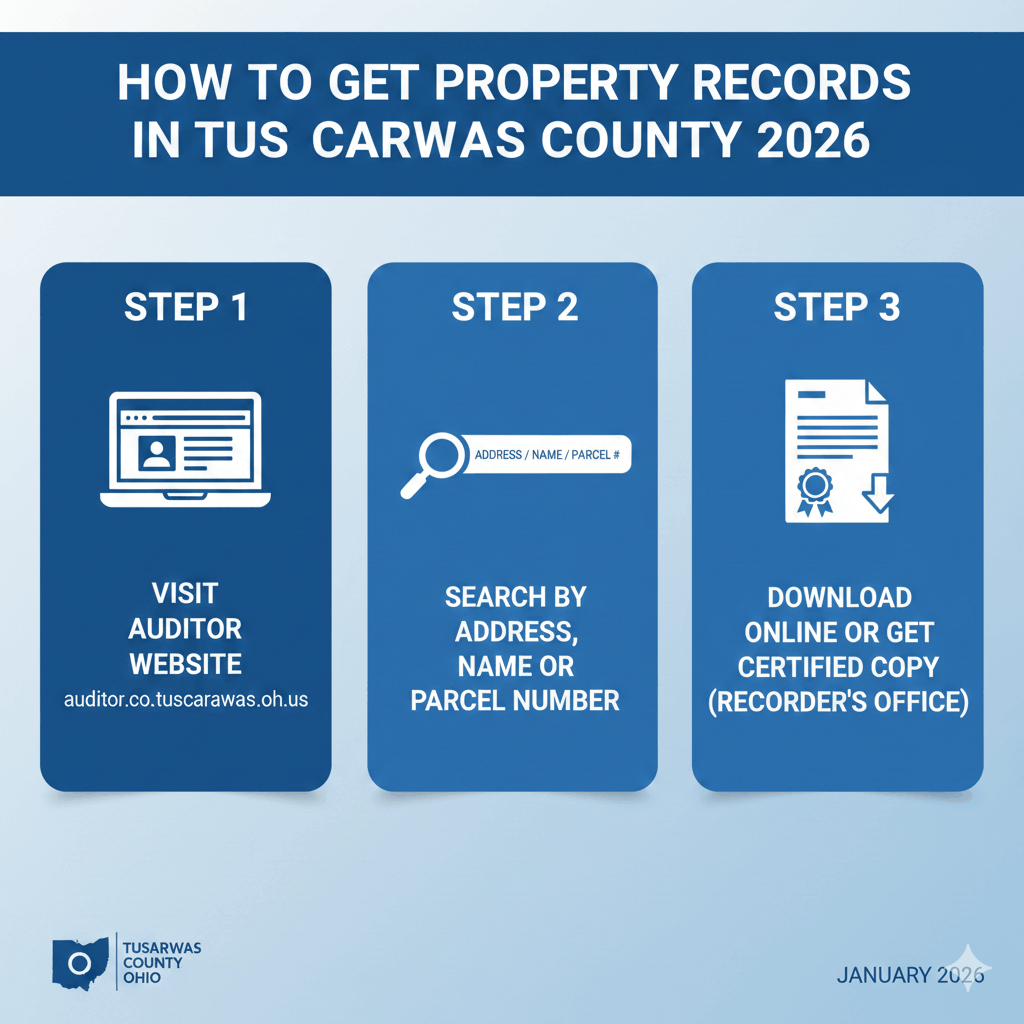

- Check the County Auditor’s Website

Tuscarawas County provides online access to property records. Look for your property by owner name, parcel number, or address to review all details. - Review Legal Documents

Compare deeds, mortgage documents, and surveys to ensure they match county records. Any discrepancies should be noted immediately. - Inspect Tax Records

Check your property tax statements for errors in assessed value, property size, or exemptions. - Hire a Professional Surveyor

If you suspect boundary issues or lot size errors, a licensed surveyor can confirm the correct information.

Correcting Property Record Mistakes

If you discover errors in your property records, it’s essential to correct them as soon as possible. Here’s how:

- Contact the Tuscarawas County Auditor’s Office

Explain the issue and provide any supporting documents, such as deeds, surveys, or legal filings. - Submit a Formal Correction Request

Some errors may require completing a form or filing a written request. Ensure all information is accurate and attach evidence. - Follow Up Regularly

Record corrections can take time. Follow up with the auditor’s office to confirm updates are made. - Seek Legal Advice if Needed

For complex issues involving ownership disputes or significant tax implications, consult a real estate attorney.

Preventing Property Record Errors

While some mistakes are unavoidable, you can take steps to reduce the risk:

- Keep all property-related documents organized and accessible.

- Verify property details when purchasing, selling, or refinancing a home.

- Review your property records annually to ensure they remain accurate.

- Notify the county immediately after property improvements, ownership changes, or boundary adjustments.

Conclusion

Property record mistakes in Tuscarawas County are more common than most people think, but they can be identified and corrected with diligence. Regularly checking your records, understanding common errors, and working closely with the county auditor’s office can prevent legal disputes, tax issues, and delays in property transactions. Accurate records not only protect your investment but also ensure peace of mind when dealing with property matters.

Top FAQs About Property Record Mistakes in Tuscarawas County

1. How can I check my property records in Tuscarawas County?

You can search online via the Tuscarawas County Auditor’s website or visit their office in person for official documents.

2. What should I do if I find an error in my property record?

Contact the auditor’s office, provide supporting documents, and submit a formal correction request.

3. How long does it take to correct property record mistakes?

Correction time varies depending on the type of error and required documentation. Minor updates may take a few weeks; complex changes can take longer.

4. Can property record mistakes affect my property taxes?

Yes, incorrect records can lead to overpayment or underpayment of property taxes, so timely corrections are crucial.

5. Do I need a lawyer to fix a property record error?

Not always. Simple clerical errors can be resolved with the auditor’s office, but legal assistance is recommended for disputes or complex ownership issues.

6. How can I prevent property record mistakes?

Regularly review your records, keep all property documents organized, and notify the county of changes promptly.

Post Comment