Property Tax Exemptions in Tuscarawas County Ohio 2026

Property taxes can be a significant expense for homeowners, and understanding potential exemptions can help you save money. Tuscarawas County 2026 Ohio, offers several property tax exemptions designed to provide financial relief to eligible residents. In this article, we’ll explore what property tax exemptions are, who qualifies for them, how to apply, and key details you need to know.

What is a Property Tax Exemption

A property tax exemption reduces the amount of tax you owe on your property. Unlike a tax deduction, which lowers your taxable income, an exemption directly lowers the assessed value of your property for tax purposes. This means you pay taxes on a smaller amount, potentially saving hundreds or even thousands of dollars annually.

Types of Property Tax Exemptions in Tuscarawas County

Tuscarawas County offers a variety of property tax exemptions. The most common include:

1. Homestead Exemption

The Homestead Exemption is designed for homeowners who occupy their property as their primary residence. It can reduce the taxable value of your home by a set amount, which in turn lowers your tax bill.

Eligibility:

- Must be the primary residence.

- Homeowners must be at least 65 years old or permanently disabled.

2. Disability Exemption

This exemption is available for residents who are permanently and totally disabled. It can significantly reduce property taxes.

Eligibility:

- Proof of permanent disability is required.

- Must be the primary property owner.

3. Veteran Exemptions

Veterans and their surviving spouses may qualify forproperty tax exemptions in Tuscarawas County. This includes exemptions for:

- Disabled veterans: Exemption is available based on the degree of disability.

- Surviving spouses: If the veteran passes away, the surviving spouse may retain the exemption.

Eligibility:

- Active military service or veteran status.

- Documentation of disability (if applicable).

4. Other Exemptions

Tuscarawas County may offer additional exemptions for:

- Senior citizens with limited income.

- Agricultural properties or land used for farming.

- Properties owned by charitable organizations.

Each exemption has specific rules, so it’s important to verify eligibility with the Tuscarawas County Auditor’s Office.

Income Limits for Property Tax Exemptions (2026)

Property tax exemptions in Tuscarawas County are also based on income limits. For 2026, homeowners applying for the Homestead Exemption must have an Ohio Adjusted Gross Income of $40,000 or less. This income limit applies to seniors, permanently disabled individuals, and surviving spouses. Income is reviewed to ensure continued eligibility, and applicants must report any changes that could affect their exemption status.

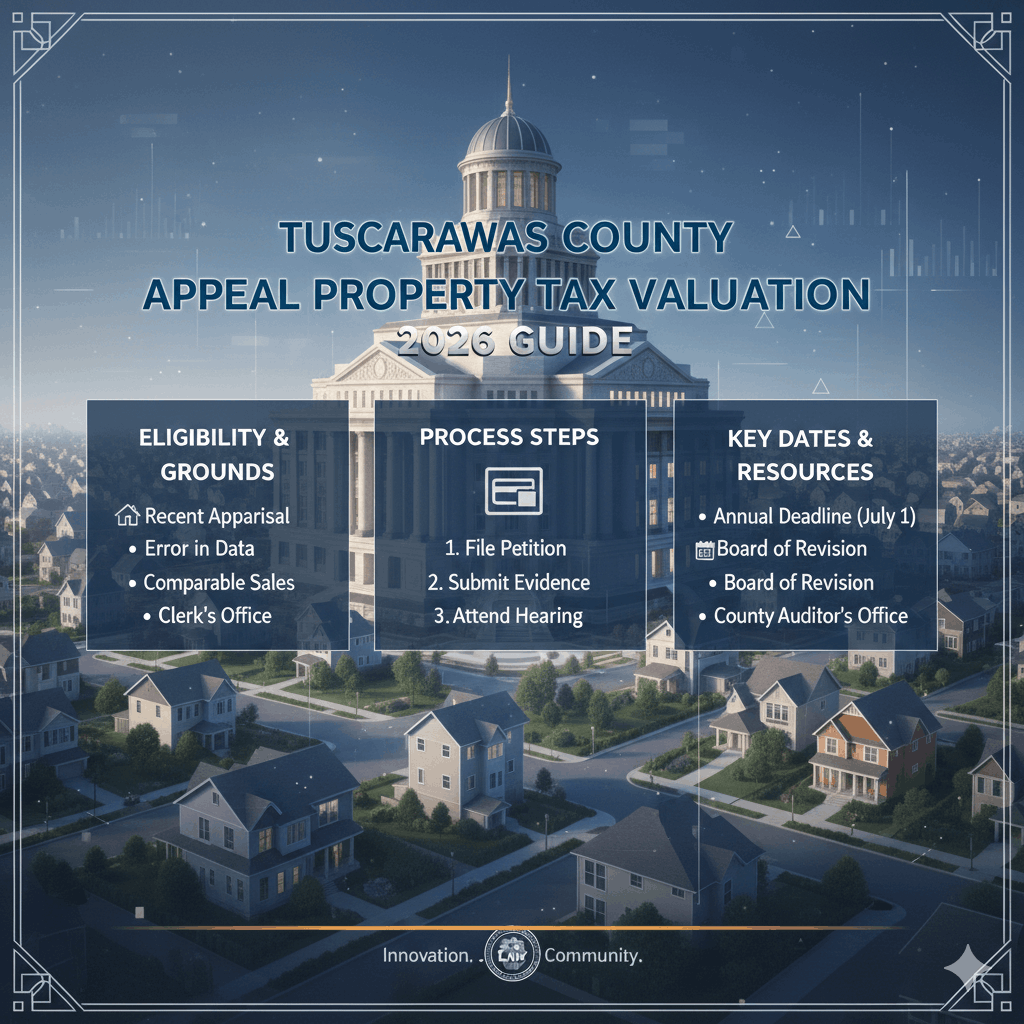

How to Apply for a Property Tax Exemption in Tuscarawas County

Applying for an exemption in Tuscarawas County is a straightforward process:

- Obtain the Application Form:

You can download the form from the Tuscarawas County Auditor’s official website or pick it up in person. - Provide Required Documentation:

Documents may include: - Submit the Application:

Submit the completed application and supporting documents to the Tuscarawas County Auditor’s Office. - Follow Up:

After submission, the auditor’s office will review your application. You may receive a letter of approval or request additional information.

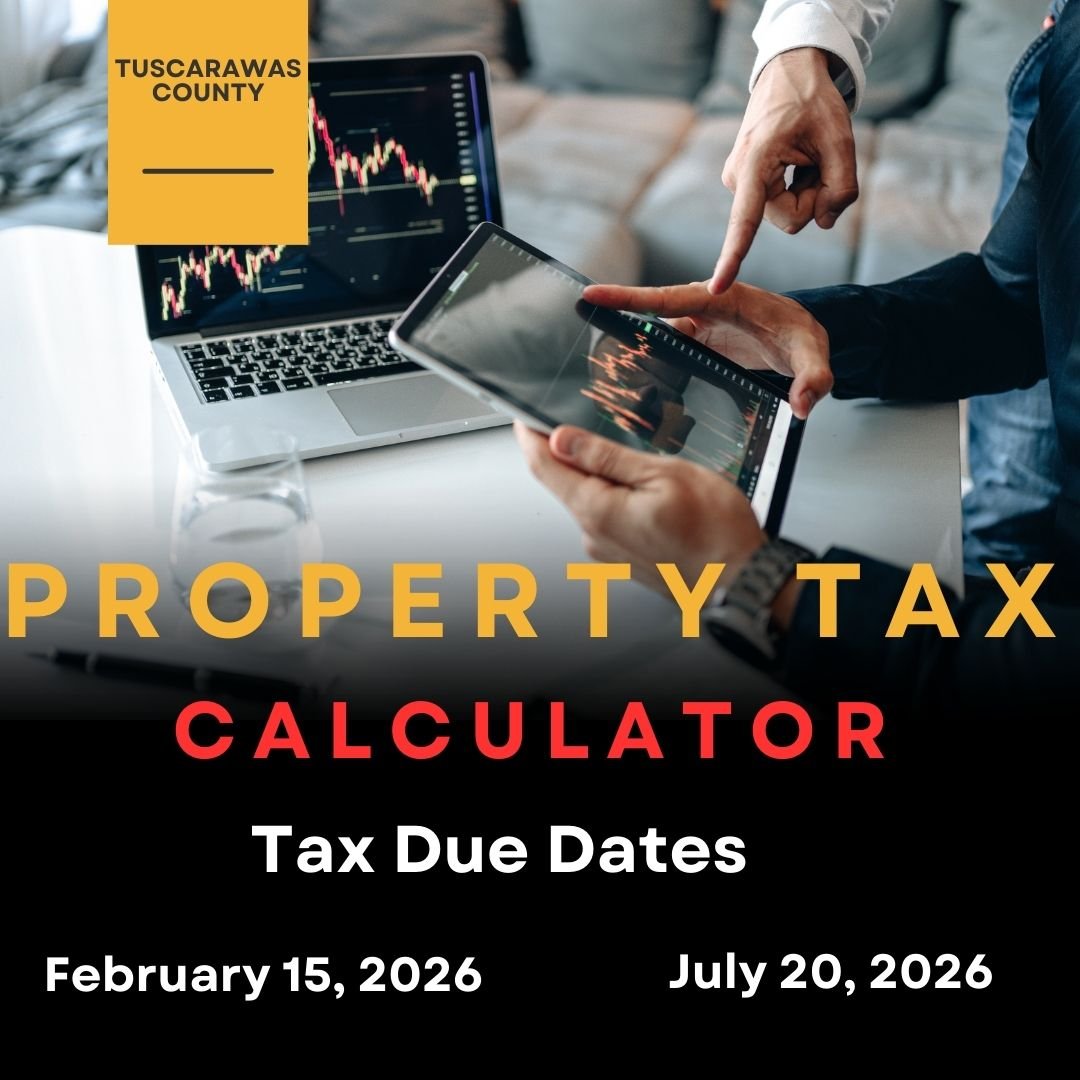

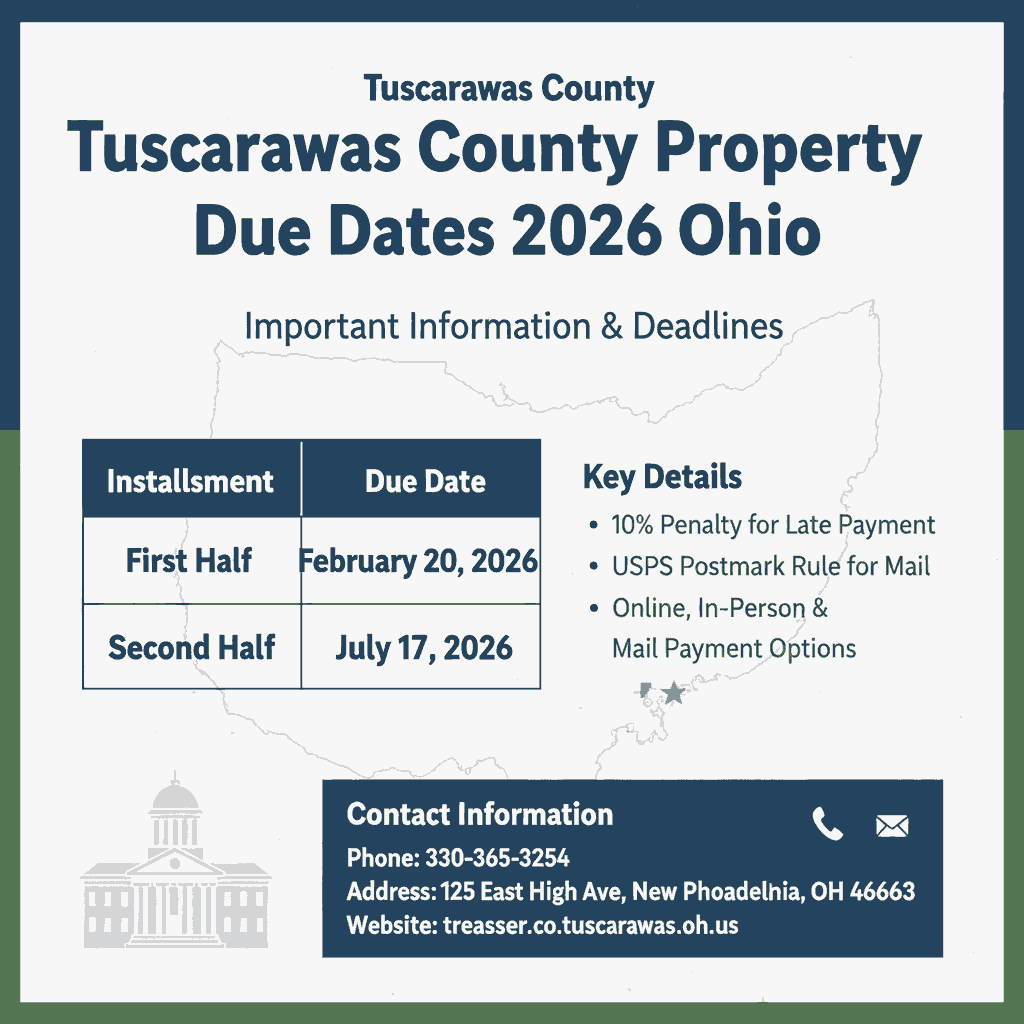

Important Deadlines

Deadlines are crucial when applying for property tax exemptions:

- Homestead Exemption: Applications should typically be submitted by December 31 for the following tax year.

- Veteran Exemption: Applications should be submitted as soon as eligibility is established.

- Other Exemptions: Check with the auditor’s office for specific dates.

Late applications may delay your exemption, so it’s important to apply on time.

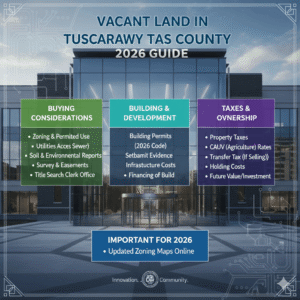

CAUV – Agricultural Property Tax Reduction

The Current Agricultural Use Valuation (CAUV) program helps farmers reduce property taxes by valuing land based on agricultural use rather than market value. In Tuscarawas County, farms over 10 acres qualify automatically, while smaller farms must earn at least $2,500 annually from agriculture. Applications must be filed between January and March with the County Auditor to receive this benefit.

Benefits of Property Tax Exemption

Property tax exemptions provide several benefits:

- Reduced Tax Burden: Pay less each year in property taxes.

- Financial Relief for Seniors and Disabled: Exemptions can significantly reduce expenses for those on fixed incomes.

- Support for Veterans: Recognizes service and provides financial assistance.Encourages Homeownership: Incentives for homeowners and community investment.

- Owner-Occupied Property Tax Reduction

Owner-occupied homes in Tuscarawas County may qualify for an additional property tax reduction known as a tax rollback. This benefit applies to homeowners who live in their property as a primary residence. The reduction helps lower the overall tax burden and is reimbursed by the state. Homeowners must apply for this reduction, as it is not always applied automatically.

Common Mistakes to Avoid

- Missing Deadlines: Always submit applications on time.

- Incomplete Applications: Ensure all required documents are attached.

- Assuming Automatic Approval: Some exemptions require yearly re-application.

- Not Updating Changes: Changes in residency or ownership must be reported.

Conclusion

Property tax exemptions in Tuscarawas County are an essential tool for homeowners to reduce their tax burden. From homestead and disability exemptions to benefits for veterans, there are multiple ways to save. Understanding eligibility, applying correctly, and staying on top of deadlines can make a significant difference in your annual property taxes. Always consult the Tuscarawas County Auditor’s Office for the most up-to-date information and assistance.

Top 6 FAQs About Property Tax Exemption in Tuscarawas County

1. Who is eligible for the homestead exemption

Homeowners aged 65 or older or permanently disabled residents living in their primary residence.

2. How do I apply for a veteran exemption

Submit the required forms and documentation to the Tuscarawas County Auditor’s Office.

3. Can I get multiple exemptions for the same property

Yes, if you qualify for more than one exemption, you may apply, but approval depends on eligibility rules.

4. When is the deadline to apply for exemptions

Typically, December 31 for the next tax year, but specific dates may vary by exemption type.

5. Do I need to reapply every year

Some exemptions require annual renewal; check with the auditor’s office for your exemption type.

6. Where can I find the application forms

Forms are available on the Tuscarawas County Auditor’s official website or at their office.

Post Comment