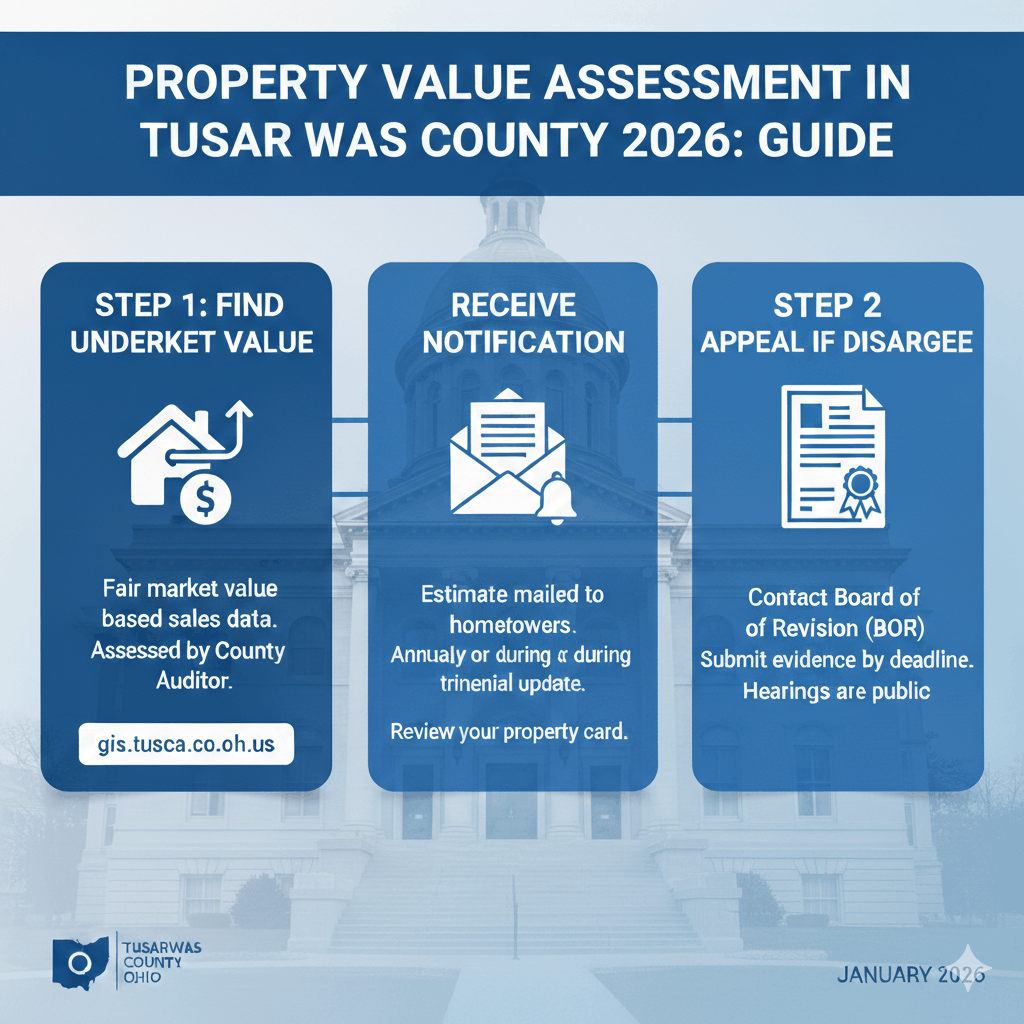

Property Value Assessment in Tuscarawas County Ohio 2026

If you own property in Tuscarawas County, understanding how your property is valued is crucial Property value assessment affects your property taxes, potential resale value, and even eligibility for certain exemptions. This guide explains the process, the factors considered, and how you can make sure your assessment is accurate.

What is Property Value Assessment?

A property value assessment is an official estimate of your property’s market value, conducted by the county auditor. It is primarily used to determine the property tax you owe. In Tuscarawas County, the Auditor’s Office is responsible for evaluating all residential, commercial, and agricultural properties.

The assessed value is not always the same as your property’s selling price. Instead, it is based on market trends, property characteristics, and county guidelines.

How Tuscarawas County Assesses Property

Tuscarawas County follows a structured approach for property valuation. The main steps include:

1. Data Collection

The Auditor’s Office collects detailed information about your property, including:

- Location: Your property’s neighborhood affects its value.

- Size of the Land : Total acreage or lot size.

- Building Size: Square footage of any structures.

- Construction Type: Materials used, age of building, and condition.

- Property Use: Residential, commercial, or agricultural purposes.

2. Market Comparison

The county compares your property with similar properties that have recently sold in the same area. This ensures your assessment reflects current market trends.

3. Valuation Methods

Tuscarawas County generally uses three common methods:

- Cost Approach: Estimates what it would cost to rebuild the property from scratch.

- Sales Comparison Approach: Compares your property to similar recently sold properties.

- Income Approach: Often used for commercial properties, estimating value based on potential income.

4. Notice of Assessment

Once the property is evaluated, the Auditor sends a Notice of Assessment to the property owner. This notice shows the assessed value and how it was determined.

Factors Affecting Property Value in Tuscarawas County

Several factors influence your property’s value:

- Location: Proximity to schools, hospitals, and commercial areas can increase value.

- Property Condition: Well-maintained properties generally have higher assessments.

- Improvements: Renovations like new roofing, kitchen upgrades, or landscaping add value.

- Market Trends: Economic changes in Tuscarawas County can affect real estate prices.

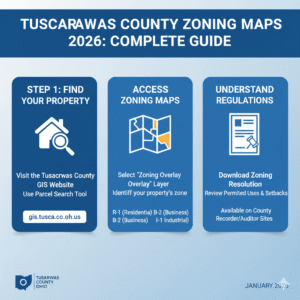

- Zoning Laws: Properties in certain zones may have restrictions affecting value.

How to Check Your Property Assessment

You can easily check your property assessment online or in-person:

- Visit the Tuscarawas County Auditor’s official website.

- Navigate to the Property Search section.

- Enter your property details, such as parcel number or address.

- View the current assessed value, property description, and recent sales data.

Checking your assessment annually helps ensure you are paying the correct taxes.

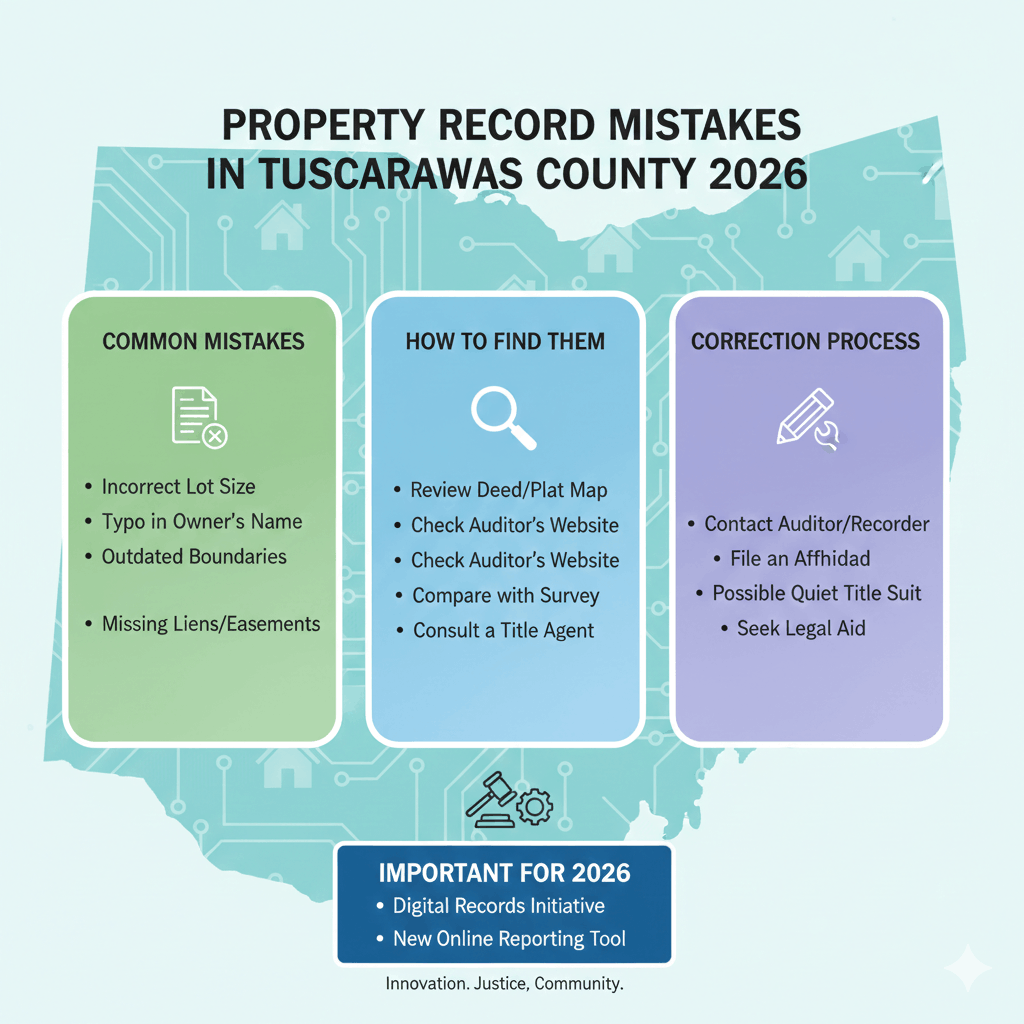

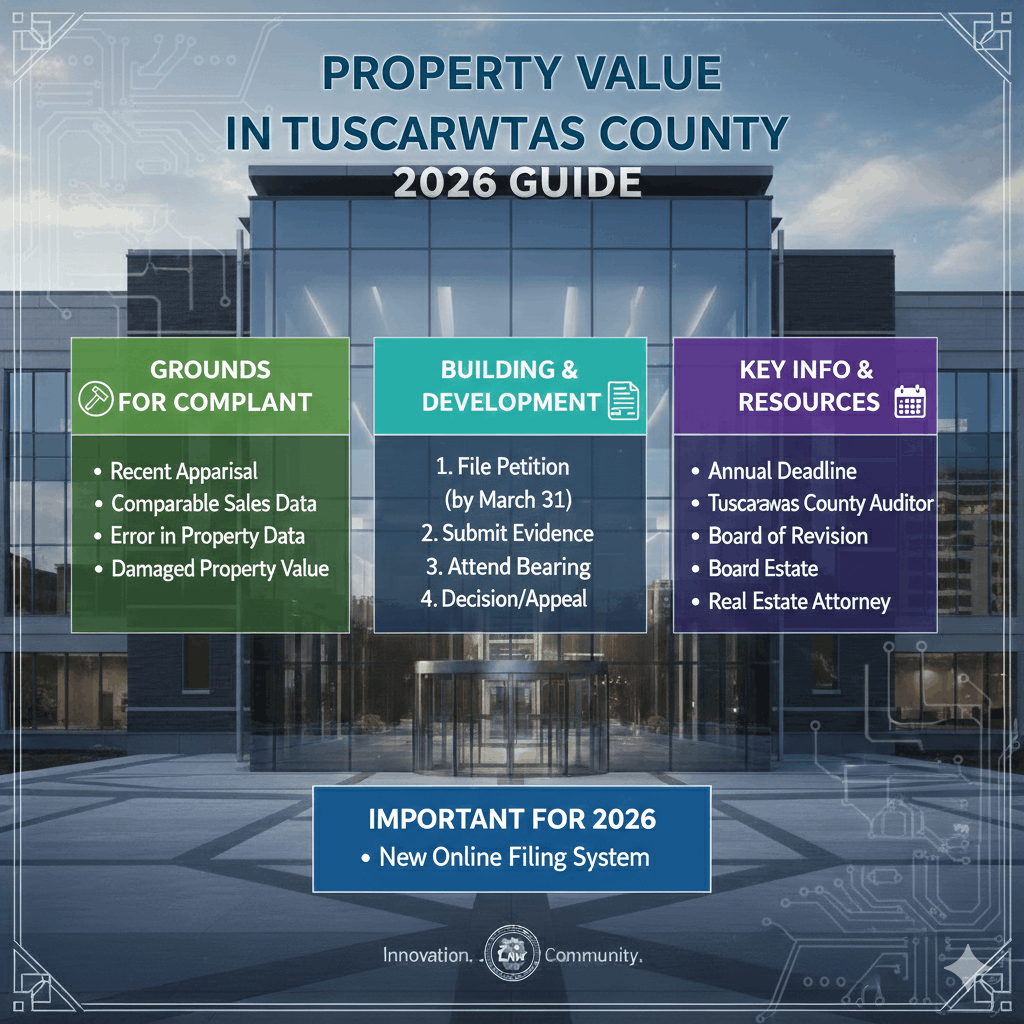

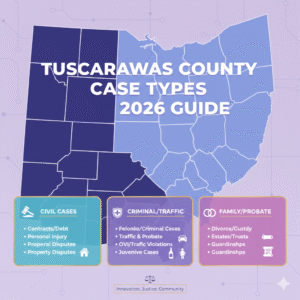

What to Do if You Disagree with Your Assessment

If you believe your property has been overvalued:

- Review the Assessment: Check property details for errors.

- Compare Similar Properties: Look at recently sold properties in your area.

- File a Complaint or Appeal: Tuscarawas County allows property owners to appeal their assessment. The appeal process usually involves submitting a formal request to the Auditor’s Office or attending a Board of Revision hearing.

- Provide Evidence: Include photographs, repair estimates, or sale data to support your claim.

Act quickly, as most counties have strict deadlines for filing appeals.

Tips to Ensure an Accurate Property Assessment

- Keep records of improvements and renovations.

- Regularly check for property data errors in the Auditor’s database.

- Stay updated on market trends in Tuscarawas County.

- Consult with a real estate professional if unsure about your property’s value.

Impact of Property Assessment on Taxes

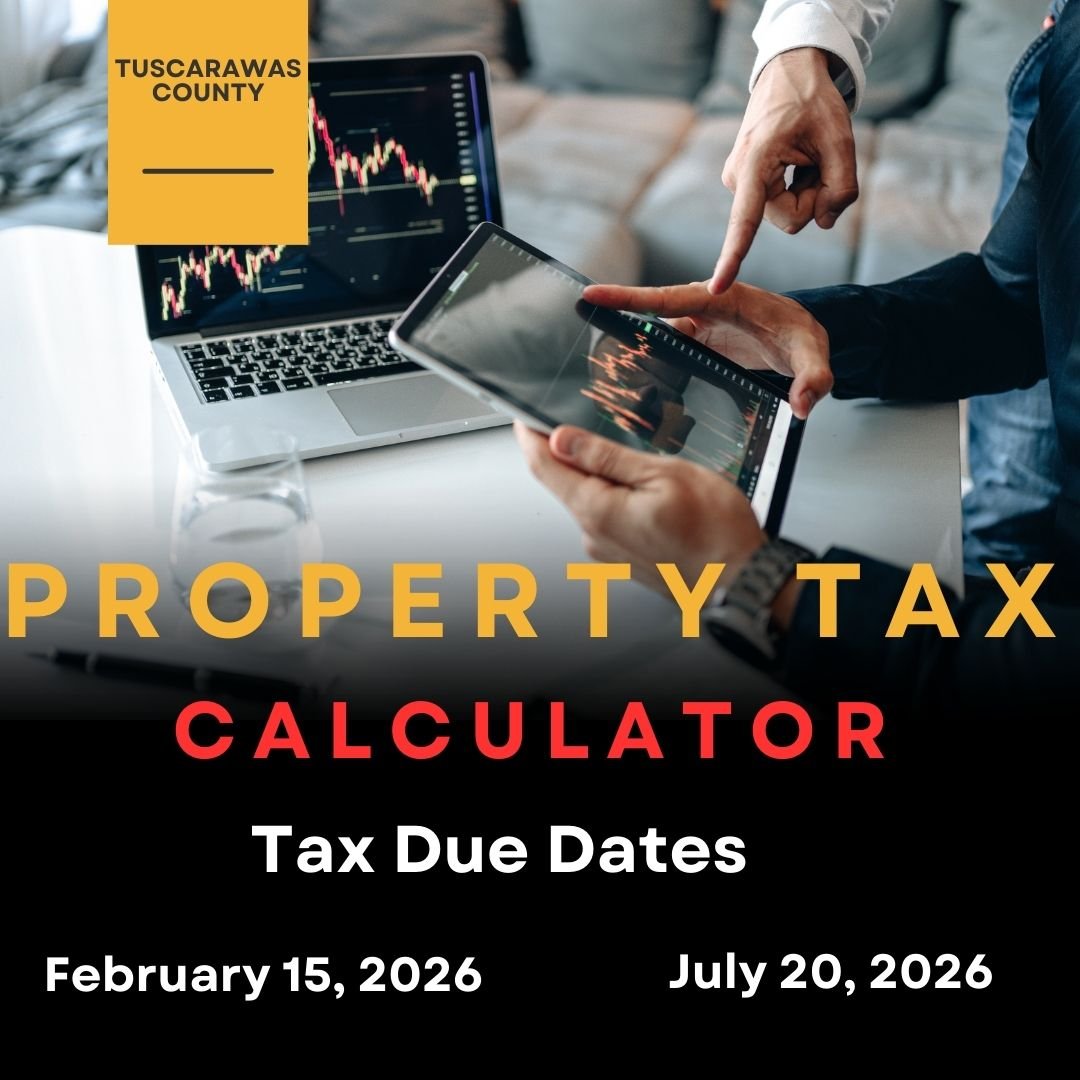

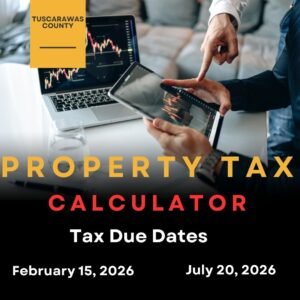

Property taxes are calculated based on your assessed value. Tuscarawas County uses a millage rate applied to the assessed value to determine your tax bill. A higher assessed value leads to higher taxes, while under-assessment may lower your taxes but can affect resale price.

Conclusion

Understanding your property value assessment in Tuscarawas County is essential for every property owner. By knowing how assessments work, checking your property’s details, and acting if you disagree, you can ensure you are being treated fairly. Staying informed also helps with planning for property taxes, potential renovations, and resale. Always remember, accurate assessments benefit both the property owner and the community.

Top FAQs about Tuscarawas County Property Assessment

1. How often are properties assessed in Tuscarawas County

Most properties are assessed every six years, but updates may happen annually based on improvements or sales.

2. Can I appeal my property assessment

Yes. You can file an appeal with the Tuscarawas County Auditor’s Office if you believe the value is inaccurate.

3. Does the assessed value equal market value

Not always. The assessed value is an estimate for tax purposes, while market value is the likely selling price.

4. How do improvements affect my assessment

Major renovations, like additions or new roofing, can increase your assessed value.

5. Where can I view my property assessment

Visit the Tuscarawas County Auditor’s website and search by parcel number or address.

6. How are property taxes calculated

Property taxes are calculated by multiplying your assessed value with the local millage rate.

Post Comment