Transfer Property Ownership process in Tuscarawas County Ohio 2026

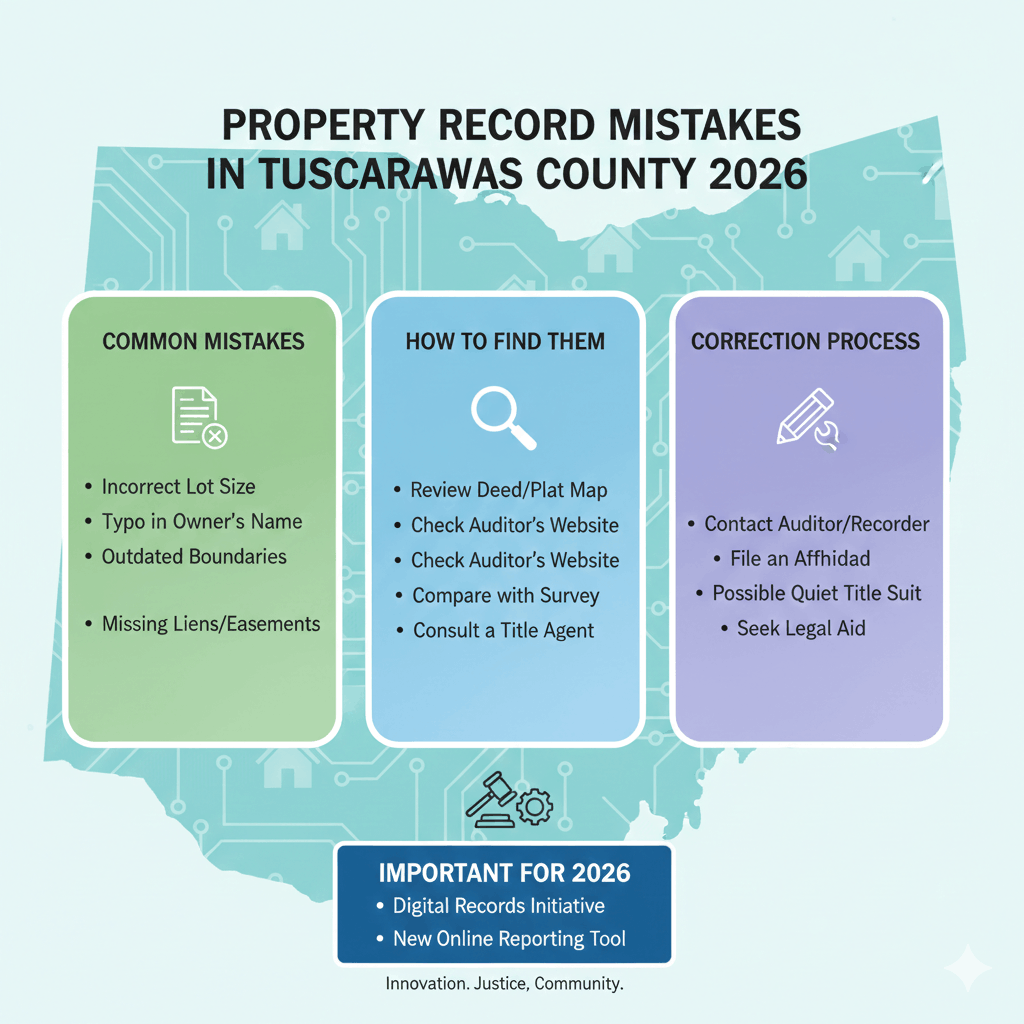

Transferring property ownership in Tuscarawas County, Ohio, requires following a structured process to ensure legal ownership and accurate county records. Whether you are transferring residential, commercial, agricultural, or mineral property, understanding the steps helps prevent delays and errors. Transfers can be completed in person or by mail, but all deeds require pre-approval before recording.

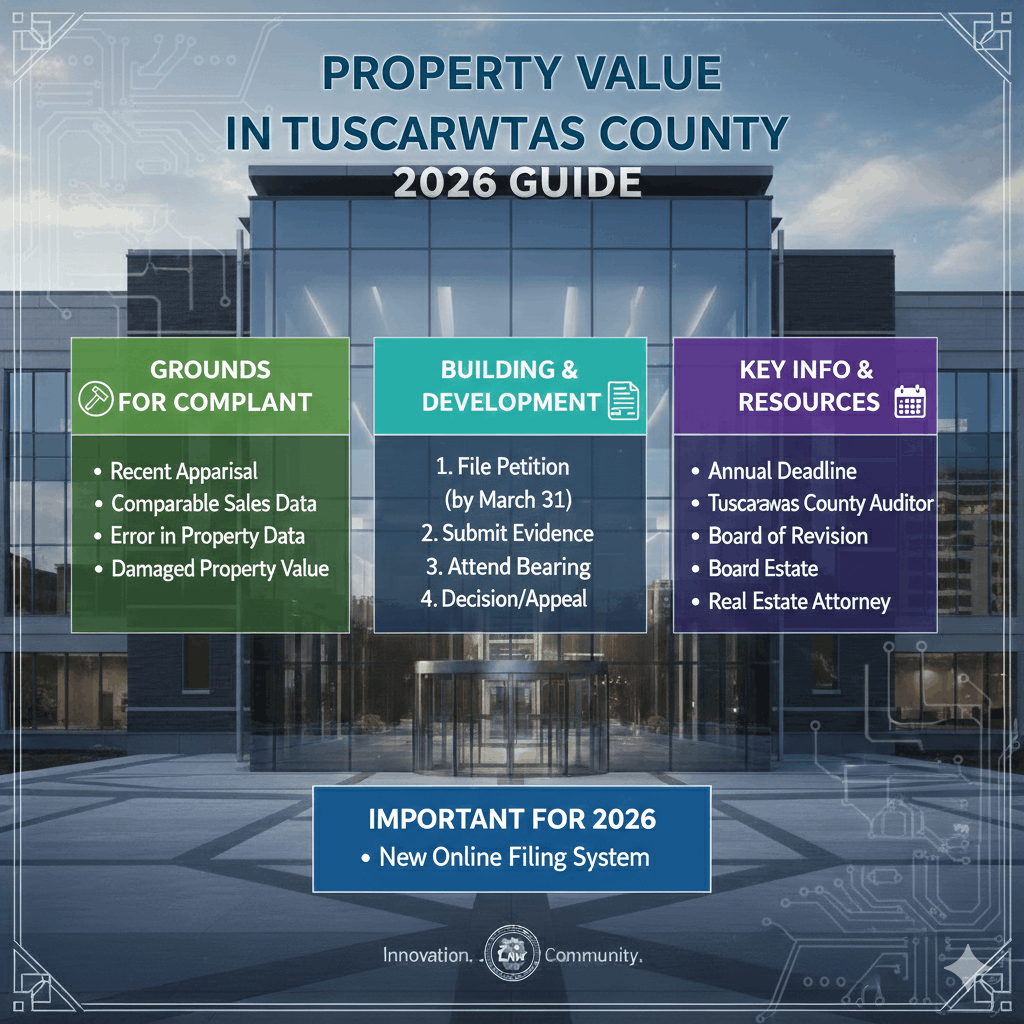

Step 1: Pre Approval for Deed Transfers

Before recording, property deeds must be pre-approved by the Tax Map Office and the County Auditor’s Office. Steps include:

- Fill out the top portion of the Deed Conveyance Requirements Form and attach all prior deeds.

- Submit a copy of the deed (not the original) to the Tax Map Office.

- For property splits:

- City/village splits require local approval.

- Township splits require approval from the County Engineer (or ODOT for State Roads), Regional Planning (if under 5 acres), and Health Department or Affidavit. Zoning approval is required in Lawrence, Dover, or Sandy Townships.

Pre-approvals usually take 7 business days (10 for Mineral Deeds) and are processed on a first-in, first-out basis. Missing information will be returned for correction.

Step 2: Recording the Deed

After pre-approval, deed recording involves three offices:

1. Tax Map Office Bring the original signed deed with the approved form. The office stamps the deed or returns it for corrections if needed.

2. County Auditor’s Office Attach the approved form, complete DTE 100/100EX forms, and pay exact fees. The Auditor will stamp the deed “TRANSFERRED.” Mineral deeds require specific conveyance fees: $4 per $1,000 for conveyance and $0.50 per legal description for transfer.

3. County Recorder’s Office The deed must have both Tax Map and Auditor stamps. Submit exact recording fees ($34 for first two pages, $8 per additional page, plus $20 if ORC standards are not met). The recorded deed is returned to you.

Step 3: Property Transfers by Mail

If mailing deeds:

- Include a self-addressed stamped envelope with sufficient postage.

- Mail copies of the deed, the Deed Conveyance Requirements Form, and the envelope to the appropriate office in order: Tax Map Office → County Auditor → County Recorder.

- Each office will review, stamp, and mail back the documents. Include exact fees and all required forms to avoid delays.

Note: Mineral deeds follow the same process but require a copy of the mineral reservation and up to 10 business days for pre-approval.

Step 4: Contact Tuscarawas County Offices

Contact Tuscarawas County Offices

| Office Name | Phone Number | Email Address |

|---|---|---|

| Tax Map / GIS Office | 330-365-3303 | gis@co.tuscarawas.oh.us |

| Auditor’s Office | 330-365-3220 | auditor@co.tuscarawas.oh.us |

| Recorder’s Office | 330-365-3284 | recorder@co.tuscarawas.oh.us |

These offices help with deed transfers, property records, tax details, and recording services. You can contact them for in-person or mail-based property transfer guidance.

TUSCARAWAS COUNTY OFFICES PROCEDURE FOR PROCESSING DEED TRANSFERS

Common Fees Involved

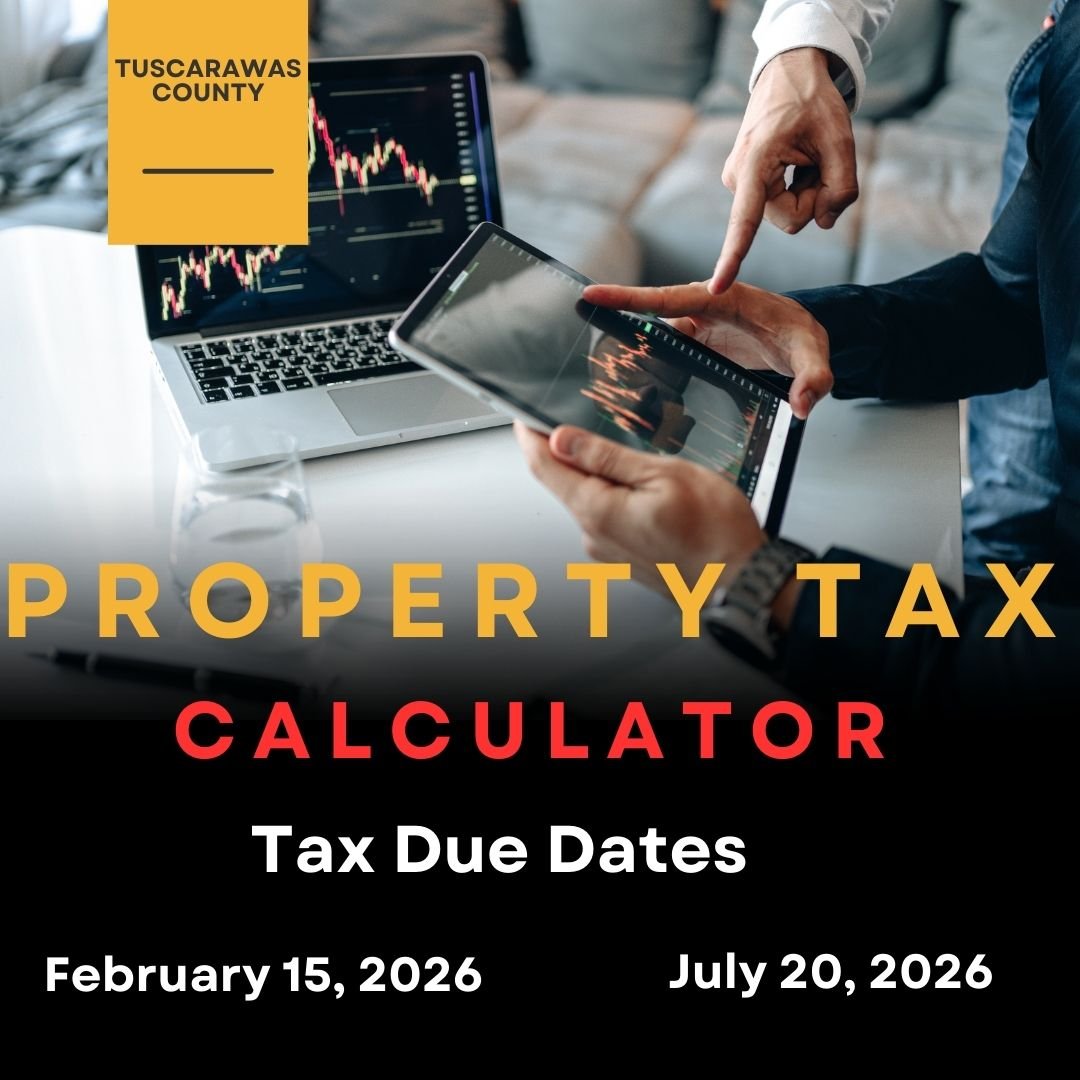

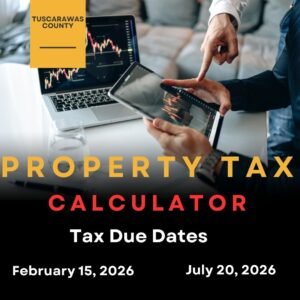

Transferring property ownership involves certain fees:

- Recording Fee: Charged by the Recorder’s Office to record the deed. Typically around $30-$50 document

- Transfer Tax: Ohio may charge a real estate transfer tax. Check with the county auditor for exact rates.

- Legal Fees: If you hire an attorney, fees may vary based on complexity.

- Title Search/Insurance: Optional but recommended to ensure the property has a clear title.

Tips for a Smooth Property Transfer

- Hire a Professional: An attorney or title company can help prevent mistakes that could delay the transfer.

- Check for Liens: Ensure the property is free from unpaid debts or legal claims.

- Use Correct Legal Descriptions: Mistakes in the property description can cause legal issues.

- Keep Copies: Always keep copies of all documents, including the recorded deed and tax certificates.

- Understand Ohio Laws: Familiarize yourself with Ohio property laws and Tuscarawas County-specific regulations.

Conclusion

Transferring property ownership in Tuscarawas County is a straightforward process when approached carefully and with the right documentation. By understanding the types of deeds, following the proper recording procedures, and keeping all records updated, you can ensure a smooth and legally secure transfer. Whether you’re buying a home, transferring family property, or handling an inheritance, following these steps will save time, avoid disputes, and protect your property rights.

FAQs About Property Transfer in Tuscarawas County

1. How long does it take to record a property transfer in Tuscarawas County?

Recording is typically completed the same day, but it may take a few days for county records to update officially.

2. Can I transfer property without a lawyer

Yes, but hiring a lawyer or title company is highly recommended to ensure accuracy and compliance with Ohio laws.

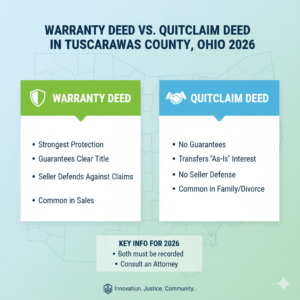

3. What is the difference between a warranty deed and a quitclaim deed

A warranty deed guarantees clear ownership and protects the buyer, while a quitclaim deed transfers whatever interest the seller has without any guarantees.

4. Are there taxes on property transfer in Tuscarawas County

Yes, Ohio may impose a real estate transfer tax, and property taxes must be current before recording the deed.

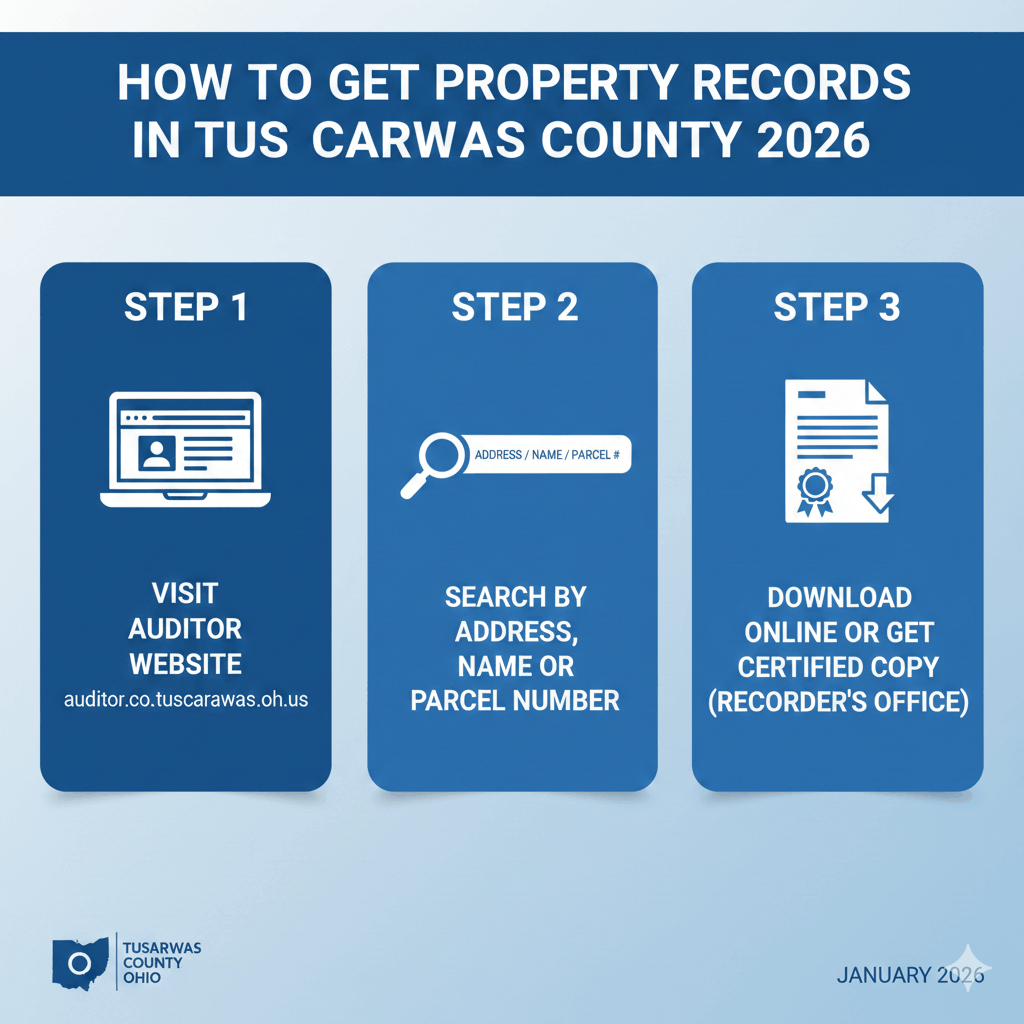

5. How do I check if my property deed has been recorded

You can contact the Tuscarawas County Recorder’s Office or check their online property records database.

6. Can property ownership be transferred to multiple people

Yes, property can be jointly owned by two or more individuals. The deed must clearly specify the ownership percentages or rights.

Post Comment