Tuscarawas County Property Tax Due Dates 2026 Ohio

Property taxes are an essential responsibility for homeowners and real estate owners in Tuscarawas County 2026 Ohio. These taxes help fund important local services such as schools, road maintenance, public safety, and county operations. To avoid late fees and penalties, it is important for property owners to understand when property taxes are due and how payments are made.

the 2026 tax year, the Tuscarawas County Treasurer’s Office has confirmed the official due dates for real estate property tax payments. This guide explains the 2026 property tax schedule, payment structure, penalties for late payments, and where to find official information.

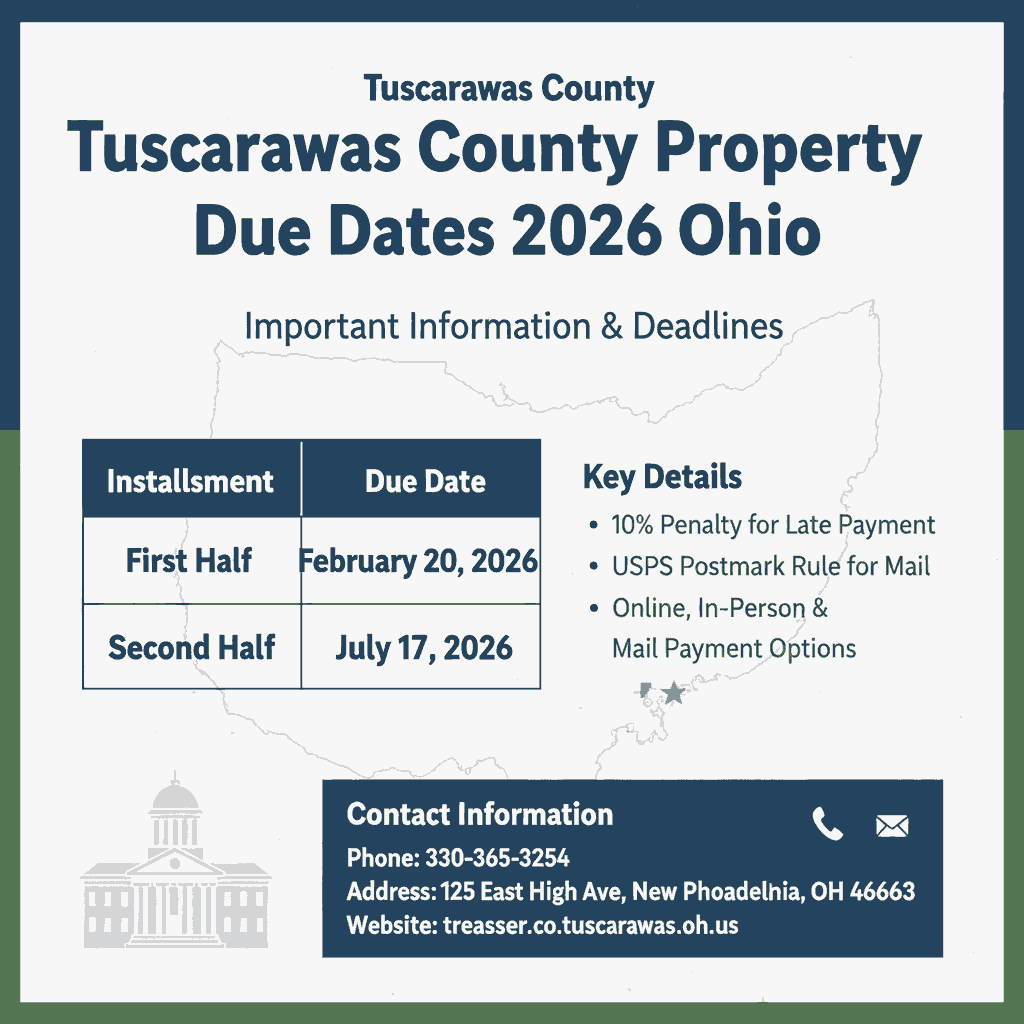

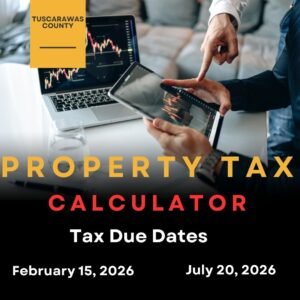

Tuscarawas County Property Tax Due Dates for 2026

Property taxes in Tuscarawas County are billed and paid twice each year. These two payments are known as the first half and second half installments.

Official 2026 Due Dates

- First Half Property Tax Due Date: February 20, 2026

- Second Half Property Tax Due Date: July 17, 2026

These dates apply specifically to real estate property taxes in Tuscarawas County, Ohio. Property owners are responsible for ensuring that payments are submitted on or before these deadlines.

First Half Property Tax Due Date February 20, 2026

The first half payment is typically issued at the beginning of the year and represents a portion of the total annual property tax bill.

What Property Owners Should Know

- The first half installment is due February 20, 2026

- Paying on time helps prevent interest and penalty charges

- This payment covers part of the assessed property tax for the year

- Most homeowners receive their tax bill well before the due date

Timely payment of the first half installment ensures that your account remains in good standing with the county.

Second Half Property Tax Due Date July 17, 2026

The second half payment completes the property tax obligation for the year.

Important Details

- The second half installment is due July 17, 2026

- It covers the remaining balance of the annual tax bill

- Failure to pay by the deadline may result in penalties and interest

- Both installments must be paid separately and on time

Even if the first half was paid correctly, missing the second half payment can still lead to additional charges.

Why Property Taxes Are Paid Twice a Year

Tuscarawas County, like many Ohio counties, divides property tax payments into two installments to make payments more manageable for property owners.

Benefits of the Two Payment System

- Reduces financial burden by splitting the total tax amount

- Helps property owners budget more effectively

- Ensures steady funding for county and local services throughout the year

This system benefits both taxpayers and local government operations.

What Happens If You Miss a Property Tax Due Date

Missing a property tax deadline can lead to financial and legal consequences.

Possible Penalties Include

- Interest charges added to the unpaid balance

- Late payment penalties

- Increased total tax owed

- Risk of tax liens or foreclosure for long-term nonpayment

To avoid these issues, property owners should mark due dates on their calendar and submit payments early when possible.

How to Pay Property Taxes in Tuscarawas County, Ohio

The Tuscarawas County Treasurer’s Office offers multiple payment options to make the process convenient for taxpayers.

Common Payment Methods:

- Online payments through the official Treasurer’s website

- Mail-in payments using a check

- In-person payments at the Treasurer’s Office

- Bank or payment service providers, where applicable

Always confirm accepted payment methods and processing times before submitting your payment.

Where to Find Official Property Tax Information

For the most accurate and up-to-date details regarding property taxes, payment options, and account balances, property owners should rely on official county resources.

Official Source

- Tuscarawas County Treasurer’s Office Website

The Treasurer’s Office provides official confirmation of due dates, payment instructions, and updates related to property tax billing.

Important Note:

Informational websites may provide helpful guidance, but only the Tuscarawas County Treasurer’s Office can offer official tax records and payment confirmation.

Tips for Property Owners in 2026

To stay organized and avoid unnecessary penalties, property owners should consider the following tips:

- Save or print your tax bill when it arrives

- Set reminders for February 20, 2026 and July 17, 2026

- Pay early to avoid last-minute delays

- Keep proof of payment for your records

- Check official county announcements for updates

Being proactive can save time, money, and stress.

Final Summary

For the 2026 tax year, Tuscarawas County property owners must remember two critical deadlines. The first half property tax payment is due on February 20, 2026, and the second half payment is due on July 17, 2026. These dates apply to real estate property taxes and are confirmed by the Tuscarawas County Treasurer’s Office.

Paying on time helps avoid penalties, protects your property investment, and supports essential county services. For official details, payment options, and account information, always refer to the Tuscarawas County Treasurer’s website.

FAQS About Tuscarawas County Property Tax Due Dates 2026 Ohio

When are property taxes due in Tuscarawas County for 2026?

In Tuscarawas County, Ohio, 2026 property taxes are due in two installments. The first half payment is due on February 20, 2026, and the second half payment is due on July 17, 2026.

Are property taxes paid once or twice a year in Tuscarawas County?

Property taxes in Tuscarawas County are paid twice a year. The total annual tax bill is divided into a first half and second half payment.

What happens if I miss the property tax due date?

If you miss a property tax due date, penalties and interest may be added to your balance. Continued nonpayment can result in tax liens or other legal action. Do these due dates apply to all property types?

Yes, the 2026 due dates apply to real estate property taxes in Tuscarawas County. Other taxes or fees may follow different schedules.

How can I pay my Tuscarawas County property taxes?

Property taxes can typically be paid through:

- Online payment options

- Mail-in payments by check

- In-person payments at the Treasurer’s Office

Always confirm payment methods on the official county website.

Where can I find official confirmation of property tax due dates

Official and up-to-date information is available through the Tuscarawas County Treasurer’s Office website, which provides payment instructions and updates.

Can I pay my property taxes early

Yes, property owners are allowed to pay before the due dates, which can help avoid late fees and processing delays.

Are property tax due dates the same every year

No, property tax due dates may change each year. Property owners should always check the official county announcements for the current tax year

What should I do if I did not receive my tax bill

If you do not receive your tax bill, you should contact the Tuscarawas County Treasurer’s Office directly. Not receiving a bill does not remove the responsibility to pay on time.

Why are property taxes important in Tuscarawas County

Property taxes help fund local schools, road maintenance, public safety, and county services, making them essential for the community.

Post Comment