Tuscarawas County Property Tax Guide 2026

Understanding property taxes can be confusing, but having a clear guide helps homeowners and potential buyers navigate Tuscarawas County 2026 Ohio’s property tax system. This article breaks down everything you need to know about property taxes, including rates, payment options, exemptions, and helpful tips.

What Are Property Taxes?

Property taxes are local taxes paid by property owners to fund public services like schools, road maintenance, and emergency services. In Tuscarawas County, property taxes are based on the value of your property, including land and structures.

The tax amount is determined by the assessed value of your property multiplied by the millage rate set by the county and local jurisdictions. Understanding these terms is key to knowing what you owe each year.

How Property Taxes Are Calculated

Tuscarawas County uses the following process to calculate property taxes:

- Property Assessment: The Tuscarawas County Auditor’s Office evaluates your property to determine its market value.

- Assessed Value: In Ohio, the assessed value is 35% of the property’s market value.

- Millage Rate: Local governments, school districts, and the county apply a millage rate (tax per $1,000 of assessed value).

- Tax Amount: Multiply the assessed value by the millage rate, then divide by 1,000.

Example:

- Market value of home: $200,000

- Assessed value (35%): $70,000

- Total millage rate: 60 mills

- Annual property tax: $70,000 × 60 ÷ 1,000 = $4,200

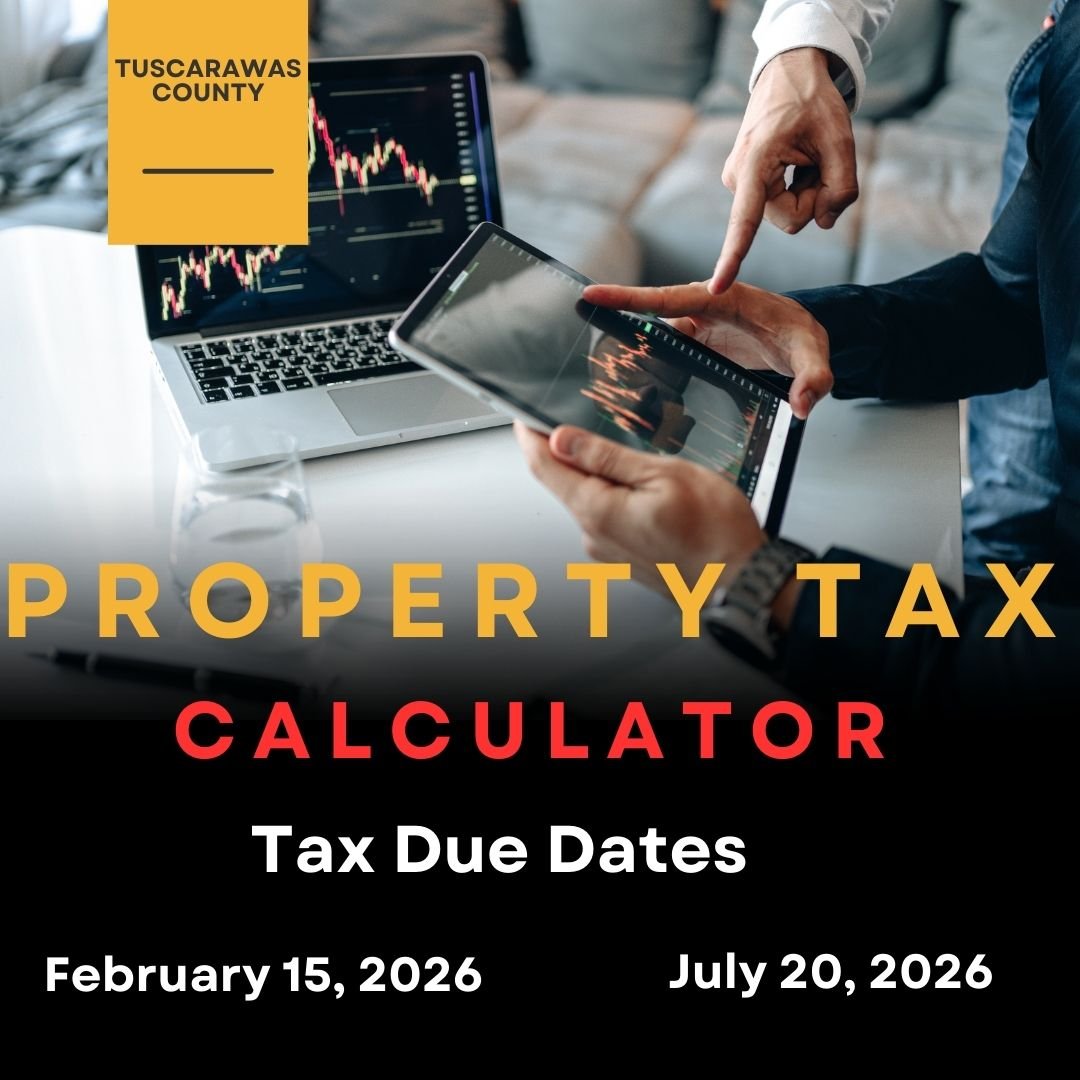

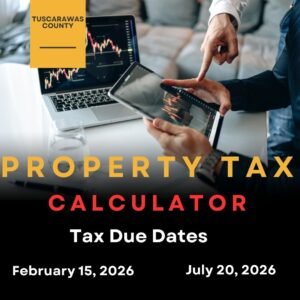

Property Tax Payment Schedule

Tuscarawas County property taxes are generally paid in two installments:

- First Half: Due by February 20

- Second Half: Due by July 20

Late payments may incur penalties and interest, so it’s important to pay on time. Payment can be made online, by mail, or in person at the Tuscarawas County Treasurer’s Office.

Ways to Pay Property Taxes

Tuscarawas County offers several convenient payment options:

- Online Payment: Visit the Tuscarawas County Treasurer’s official website for secure payment via credit or debit card.

- Mail: Send your payment with the coupon provided in your tax statement.

- In-Person: Pay directly at the Treasurer’s Office.

Always keep your payment receipts for records. Some banks also allow direct payments to the county, so check with your financial institution.

Property Tax Exemptions and Reductions

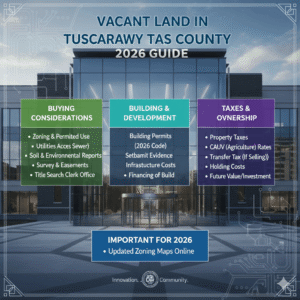

Certain property owners may qualify for tax reductions or exemptions in Tuscarawas County:

- Homestead Exemption: Seniors and disabled residents may qualify for a reduction in taxable value.

- Senior Citizen and Disabled Tax Credits: Age and income requirements may provide additional credits.

- Agricultural Use: Land used for farming may be assessed at a lower rate.

- Charitable and Government Properties: Nonprofits and government properties may be exempt from property taxes.

Applying for these exemptions usually requires documentation submitted to the Tuscarawas County Auditor.

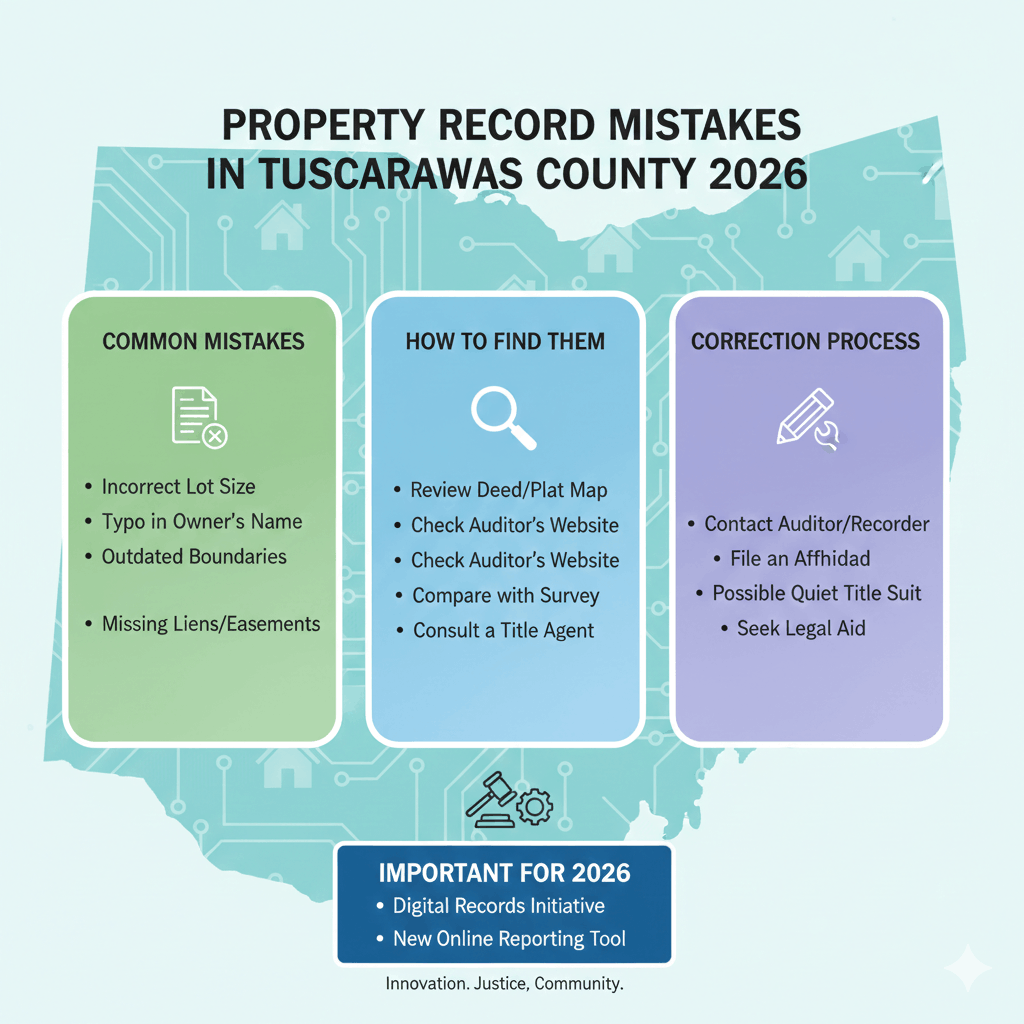

Understanding Your Property Tax Bill

Your property tax bill contains essential information:

- Owner’s Name and Address

- Property Description (parcel number, legal description)

- Assessed Value

- Millage Rates

- Tax Due Dates

Carefully reviewing your tax bill ensures there are no errors. If you notice discrepancies, contact the Tuscarawas County Auditor immediately.

Tips to Manage Property Taxes

- Check Your Assessment Annually: Ensure your property value is accurate and request a reassessment if it seems too high.

- Stay on Top of Deadlines: Avoid late fees by marking payment due dates on your calendar.

- Apply for Exemptions Early: Some exemptions require annual applications.

- Budget for Taxes: Include property taxes in your monthly budget to avoid surprises.

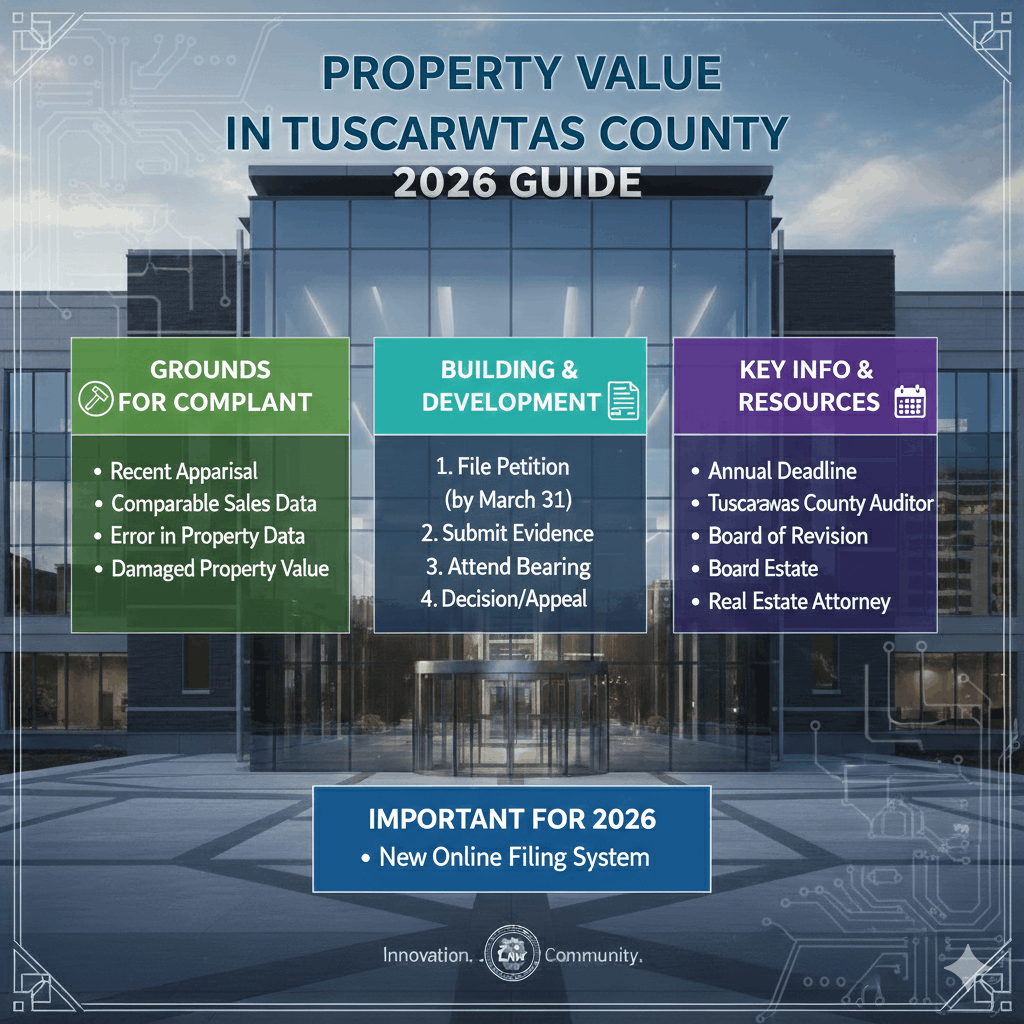

Appeal Process

If you believe your property is overvalued, you have the right to appeal the assessment. The process includes:

- Filing a complaint with the Tuscarawas County Board of Revision.

- Providing evidence of comparable property values or recent appraisals.

- Attending a hearing to present your case.

Successful appeals can reduce your assessed value and lower your tax bill.

Conclusion

Tuscarawas County property taxes are an essential part of funding local services. By understanding how taxes are calculated, knowing your payment options, and taking advantage of exemptions, homeowners can manage their taxes efficiently. Regularly reviewing your property assessment and staying informed about tax deadlines will help you avoid penalties and make the process less stressful.

Top FAQs About Tuscarawas County Property Tax

1. When are Tuscarawas County property taxes due

Property taxes are due in two halves: February 20 and July 20 each year.

2. How are property taxes calculated

Taxes are based on 35% of your property’s market value, multiplied by the total millage rate.

3. Can I pay my property taxes online

Yes, payments can be made securely via the Tuscarawas County Treasurer’s website.

4.Are there any exemptions available

Yes, exemptions include homestead for seniors and disabled residents, agricultural use, and certain charitable properties.

5. What happens if I pay late

Late payments may incur penalties and interest. Contact the Treasurer’s Office for details if you cannot pay on time.

6. How can I appeal my property assessment

File a complaint with the Board of Revision, provide supporting evidence, and attend a hearing. Successful appeals can lower your tax bill.

Post Comment