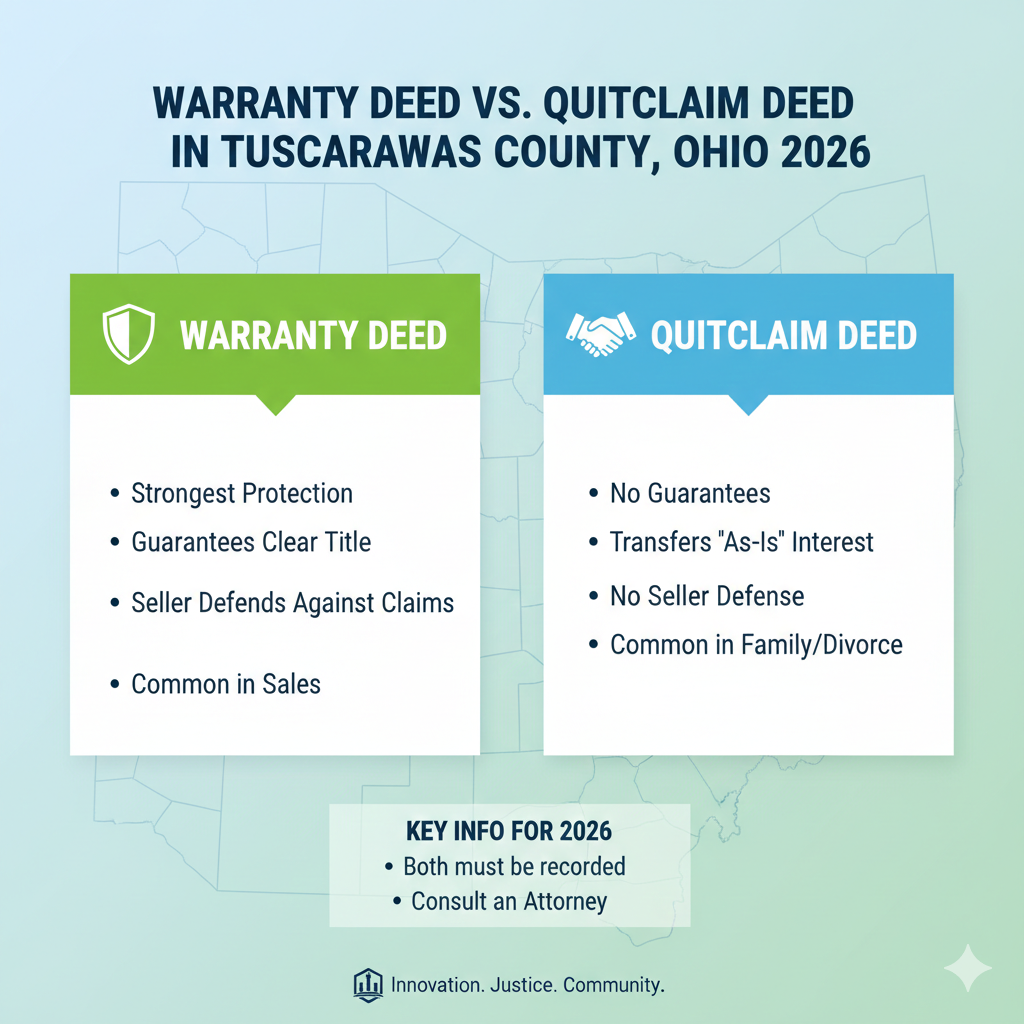

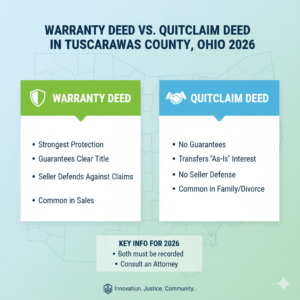

Warranty Deed vs Quitclaim Deed in Tuscarawas County Ohio 2026

When you Are buying or transferring real estate in Tuscarawas County Ohio, understanding the type of deed you are dealing with is crucial. Two of the most common deeds are Warranty Deeds and Quitclaim Deeds in 2026. While they may sound similar, they serve very different purposes and carry different levels of protection for buyers and sellers. Choosing the right deed can save you from potential legal and financial headaches down the line.

In this guide, we’ll break down the differences between a Warranty Deed and a Quitclaim Deed in Tuscarawas County Ohio, explain when to use each, and provide guidance to ensure your property transactions are secure.

What is a Warranty Deed in Ohio?

A Warranty Deed is the most protective type of property deed for buyers. It guarantees that the property title is clear of any liens or legal claims, except those explicitly stated in the deed. In other words, the seller assures the buyer that they fully own the property and have the right to transfer it.

Key Features of a Warranty Deed:

- Full Ownership Guarantee: The seller promises they legally own the property and can sell it.

- Protection Against Past Claims: If a previous owner had unpaid debts or legal issues tied to the property, the buyer is protected.

- Legal Recourse: If a title problem arises later, the buyer can hold the seller legally responsible.

In Ohio, a Warranty Deed often includes phrases like “grant, bargain, and sell” or “warrant and defend,” which reinforces the seller’s commitment to a clear title.

What is a Quitclaim Deed in Ohio?

A Quitclaim Deed in Tuscarawas County on the other hand, provides no guarantees about the property title. The seller simply transfers whatever interest they may have in the property, if any, to the buyer. This means that if there are liens, unpaid taxes, or legal claims, the buyer receives the property as-is.

Key Features of a Quitclaim Deed:

- No Title Warranty: The seller does not guarantee they own the property fully or that the title is clear.

- Transfers Interest Only: The deed only transfers the ownership interest the seller currently holds.

- Common in Certain Situations: Quitclaim deeds are often used between family members, divorces, or to correct a previous deed mistake.

Because of the lack of protection, buyers using a Quitclaim Deed are taking on more risk. A title search is strongly recommended before proceeding.

Differences Between Warranty Deed and Quitclaim Deed in Ohio

Here’s a side-by-side comparison to make things clearer:

| Feature | Warranty Deed | Quitclaim Deed |

| Title Guarantee | Full guarantee | No guarantee |

| Legal Protection | Buyer can sue if title defects arise | No recourse for buyer |

| Typical Use | Home sales to unrelated buyers | Family transfers, divorces, or corrections |

| Risk Level for Buyer | Low | High |

| Title Insurance | Often recommended but less critical | Highly recommended |

The main takeaway: if you want security and protection, a Warranty Deed is the safer choice. A Quitclaim Deed is generally for situations where the buyer trusts the seller or the transaction is low-risk.

When to Use a Warranty Deed in Ohio

A Warranty Deed is ideal for:

- Traditional Home Sales: When buying from a stranger, you want full protection against any title issues.

- Securing a Mortgage: Lenders often require a Warranty Deed to ensure the property title is clear.

- Preventing Future Disputes: If there’s a chance of disputes over ownership, a Warranty Deed provides legal coverage.

In Ohio, a properly executed Warranty Deed must be signed, notarized, and recorded at the county recorder’s office to be valid.

When to Use a Quitclaim Deed in Ohio

A Quitclaim Deed works best in low-risk or internal transactions:

- Transferring Property Between Family Members: Parents transferring a home to children or between spouses during divorce.

- Fixing Title Errors: Correcting mistakes in a previously recorded deed.

- Gifting Property: When no money is exchanged, and the buyer understands the risk.

While convenient, a Quitclaim Deed does not eliminate the need for a title search, especially if the property has a complex history.

How to Record a Deed in Ohio

Recording a deed in Ohio is straightforward but important for legal protection:

- Prepare the Deed: Ensure it is drafted correctly with the full legal description of the property.

- Sign and Notarize: Both Warranty and Quitclaim Deeds require notarization.

- Submit to County Recorder: File the deed at the county recorder’s office where the property is located.

- Pay Recording Fees: Fees vary by county but are usually around $30–$50.

- Obtain a Copy: Keep a certified copy for your records.

Recording the deed makes it official and provides public notice of the ownership transfer.

Conclusion

Understanding the difference between a Warranty Deed and a Quitclaim Deed in Ohio isessential for any real estate transaction. A Warranty Deed offers the highest level of protection for buyers, guaranteeing a clear title andproviding legal recourse if problems arise. A Quitclaim Deed is faster and simpler but carries more risk, making it best suited forfamily transfers, divorce situations, or correcting previous deeds.

Before signing any deed, consider consulting a real estate attorney or conducting a title search to ensure a smooth transfer. Making an informed decision protects your investment and prevents legal disputes in the future.

Frequently Asked Questions FAQs

1. Can a Quitclaim Deed in Ohio be used for a home sale

Yes, but it’s risky. Buyers should get a title search and consider title insurance to avoid potential issues.

2. Does a Warranty Deed guarantee no past debts on the property

Yes, it guarantees the seller is responsible for any title issues or claims from previous owners.

3. Which deed is faster to process

A Quitclaim Deed is generally faster and simpler because it involves fewer legal assurances.

4. Do both deeds need to be notarized in Ohio

Yes, both Warranty and Quitclaim Deeds require notarization to be legally valid.

5. Can a Quitclaim Deed be converted to a Warranty Deed

No, a Quitclaim Deed transfers only the interest held by the seller. To provide full warranty protection, a new Warranty Deed must be executed.

6. Is title insurance necessary for a Quitclaim Deed

Highly recommended. Since a Quitclaim Deed offers no guarantees, title insurance protects the buyer from unknown claims or liens.

Post Comment